Using AI tools to help SNAP recipients navigate simplified reporting and reduce state error rates

One of the trickiest parts of being on SNAP is knowing when to report changes to a SNAP office so the household receives the correct benefit amount. We've been testing OpenAI’s Agent Builder tool to see if we could help people answer a surprisingly complex question: "Do I need to report this change to SNAP?", and in doing so use AI to close the communication gap between program administrators and SNAP recipients.

The simplified reporting problem#the-simplified-reporting-problem

Simplified reporting is a SNAP policy option that most states have adopted to reduce paperwork for SNAP recipients and administrative burdens for state agencies. Instead of requiring households to report every change in their circumstances during their certification period, simplified reporting limits what needs to be reported to just a few critical changes:

- When household income (based on the household size) goes from under its reporting threshold to above it;

- When a household member is subject to ABAWD work requirements in order to receive SNAP, and their work hours decrease below 20 per week;

- They have substantial lottery or gambling winnings in a given month ( currently $4,500 or more in 2025-26).

Without simplified reporting, households must report all changes. This is cumbersome to both clients and to states because these changes must be reported and processed, but they are seldom substantive enough to affect the household’s benefit level to a significant degree.Simplified reporting acknowledges that most SNAP reporting changes outside of the scenarios above don’t actually affect SNAP eligibility or benefit amount enough to justify the administrative burden of processing these changes. Simplified reporting also has the added benefit of improving program access and Payment Error Rates (PER). Research has shown simplified reporting helps both clients and state administrators when implemented well. As a result, every state but one has adopted simplified reporting for their SNAP caseloads.

But here's the catch: simplified reporting only works if people understand confidently when they need to report and when they don't. The reporting parameters above are not exactly straight-forward, and that’s where confusion often creeps in.

Simplified reporting in action#simplified-reporting-in-action

Let's start with a real scenario that I was asked about recently for a SNAP household:

"I receive SNAP benefits for 5 people, and I live in Virginia. We just won $4,000 on scratchers. Do I need to report it?"

This seems straightforward. But the answer depends on understanding:

- Whether Virginia uses change reporting, or simplified reporting (Virginia uses simplified reporting)

- What is the threshold for “substantial” lottery winnings in Virginia ($4,500 as of October 2025)

- Whether lottery winnings might count as income or assets for simplified reporting purposes

- How and when to report if reporting is required

For someone just trying to keep their benefits, this is a lot. And getting it wrong has consequences in both directions:

- Reporting when they don't need to: Unnecessary stress and possibly having benefits decrease when they don’t need to

- Not reporting when they should: Risk of having an overpayment that they have to pay back, or even being accused of an Intentional Program Violation for withholding the change.

Why this matters for states#why-this-matters-for-states

State administrators also have a clear reason to make sure simplified reporting is followed correctly. When recipients over-report, it creates unnecessary work for the states because these changes must be reviewed and processed. On the other hand, if people don't report required changes, states could end up with:

- Payment errors that are identified by state and federal quality control reviews

- Potential federal penalties if error rates exceed designated thresholds

- Increased costs of investigating and recovering overpayments

With H.R.1 increasing federal scrutiny on benefit program integrity, states are under more pressure than ever to keep their error rates low. Clear reporting guidance helps both recipients and state programs succeed.

What we're testing: an AI agent for simplified reporting#what-were-testing-an-ai-agent-for-simplified-reporting

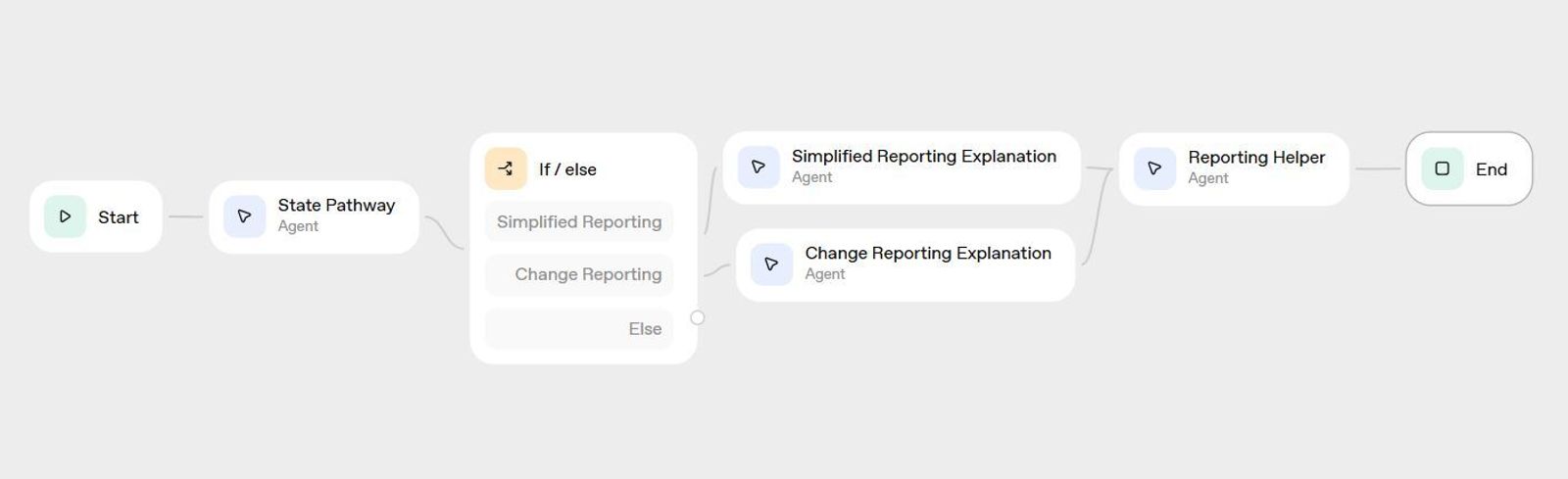

As part of Propel's AI Safety Net Residency, we've been testing an AI workflow that helps people determine whether they need to report a household change. Here's how it works:

Input: A natural language description of a household change: "I live in CA and my monthly work hours went down from 120 to 60 — should I report this?"

From this short statement, the agent then:

- Identifies which state the person lives in

- Searches for that state's simplified reporting policy

- Compares state policy against relevant federal regulations

- Analyzes whether the change meets simplified reporting thresholds

- Provides a clear, concise answer at a 6th-grade reading level

- Explains next steps and links to the state reporting portal or generates an email template if needed

Let's walk through the Virginia lottery example again:

"I'm in a 5 person household in Virginia. We just won $4,000 in scratchers. Do I need to report it for SNAP?"

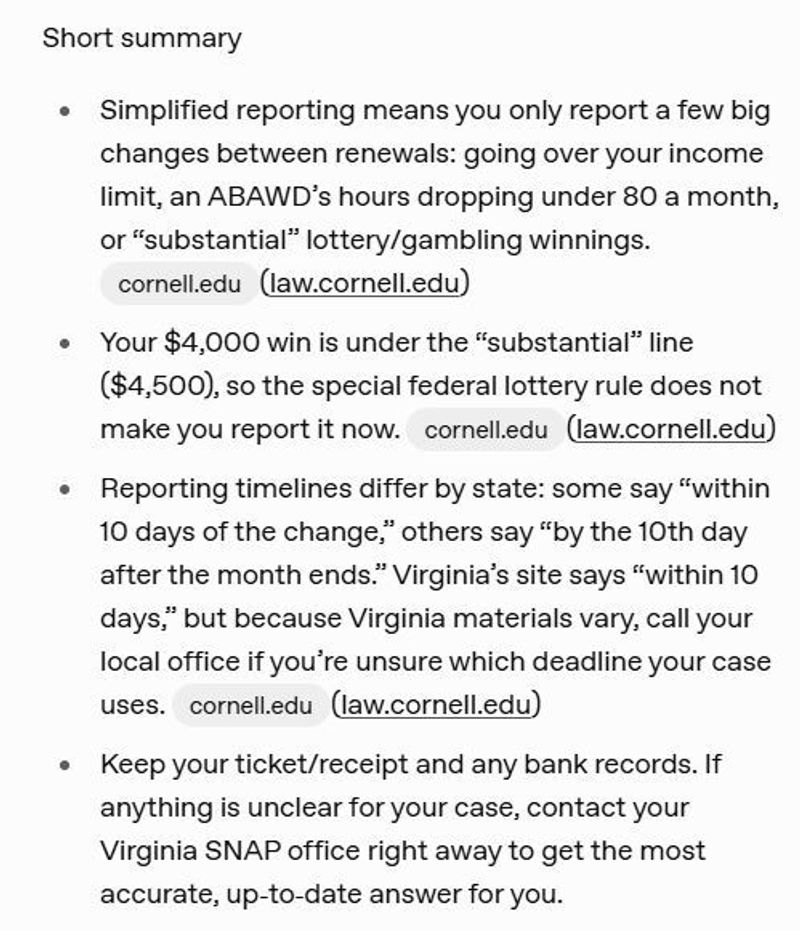

The agent searches for Virginia's simplified reporting thresholds and finds the SARVDSS (Semi-Annual Report Virginia Department of Social Services) form requirements. It identifies that $4,500 is Virginia's substantial change threshold for lottery/gambling winnings in a single instance.

Here’s what the agent told us to do in this scenario:

Your win is $4,000. The “substantial winnings” rule starts at $4,500. Because $4,000 is below $4,500, the special federal rule to report lottery/gambling winnings does not apply to you. You do not lose SNAP because of this win by itself.”

The agent also created a high-level summary and also explained work requirement rules since they have different reporting requirements.

This is part of something bigger#this-is-part-of-something-bigger

While a simplified reporting agent is useful on its own, this work is part of a broader project focused on SNAP error rates.

The truth is that most SNAP errors aren't the result of bad actors, but the result of complex regulations that are hard to understand and life circumstances that change frequently. This creates communication gaps between recipients and agencies that everyone wants to avoid.

We're exploring how AI can help close those gaps:

- Tools that empower recipients to review and correct the information they’ve shared with their state agency in order to reduce error rates for states and help clients feel in control of their cases.

- Systems that help eligibility workers feel more confident in conducting interviews through guided prompts, and suggested language to make questions and concepts easy to understand for clients;

- Find clear, actionable connection points between SNAP & Medicaid work requirements to ensure clients and workers identify applicable exemptions across programs.

We believe that by creating responsive, well-designed tools that help clients and support states, we can help everyone successfully navigate program changes and alleviate confusion..

We welcome feedback, particularly from two groups:

- State SNAP administrators: If error rates, or other implementation challenges of H.R.1 are a concern for your state and you'd like to explore how Propel might help, let's talk

- SNAP outreach partners and advocates: If you have examples of reporting situations you've found confusing, we'd love to hear them so we can test this tool against them

Email at joel.mcclurg@joinpropel.com

Agent workflow generated with OpenAI’s Agent Builder. Blog post developed with the help of Claude Sonnet 4.5