August 2025 Pulse Survey

Summary

Gains in food security over the past year have plateaued, while mounting financial strain leaves households with little cash, rising debt, and widespread late payments on rent and utilities.

The following insights come from a <10-minute multiple choice and open response survey conducted by Propel. This month, responses came from 1,779 randomly selected households out of more than 5 million Propel users from August 1 - 14, 2025. All respondents are EBT cardholders.

Food Insecurity#food-insecurity

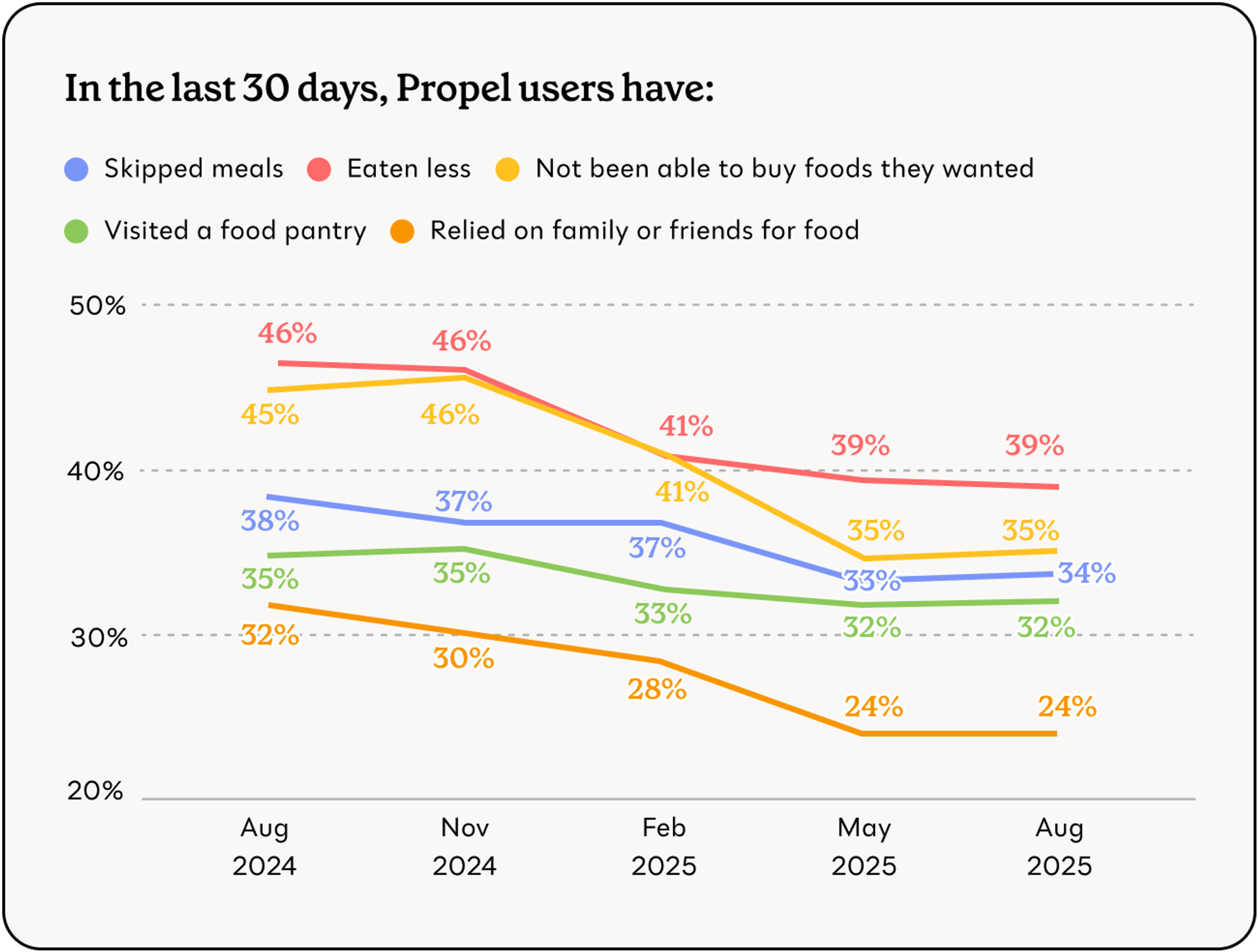

In general, households appear to be more food secure than they were a year ago, but progress has stalled in the last quarter. Over a third of respondents report eating less, skipping meals, and not being able to buy the kinds of food they want, and nearly a third still rely on food pantries to feed their household each month. Additionally, over half of respondents are unsure if the food they have will last – a percentage that has grown since our last survey.

- 53% said they are worried that their food will run out before they can buy more, a 6% increase from May 2025.

- 39% reported eating less in the last 30 days, the same percentage as May but down 15% from August 2024.

- 35% were not able to buy the kinds of food they wanted, the same percentage as May but down 22% from last August.

- 34% reported skipping meals, virtually unchanged since May but down 12% from last August.

- 32% visited a food pantry in the last 30 days, virtually unchanged from a year ago.

- 24% relied on family and friends for groceries, the same percentage as May but down 24% from last August.

“I have only $1,600 to live off of and they knocked down my food stamps to $59! That might cover a week's worth of groceries if I'm extremely conservative and eat unhealthy stuff...The government wants us to be healthier but I can't afford to be healthier.” – Jody, North Carolina

Financial Insecurity#financial-insecurity

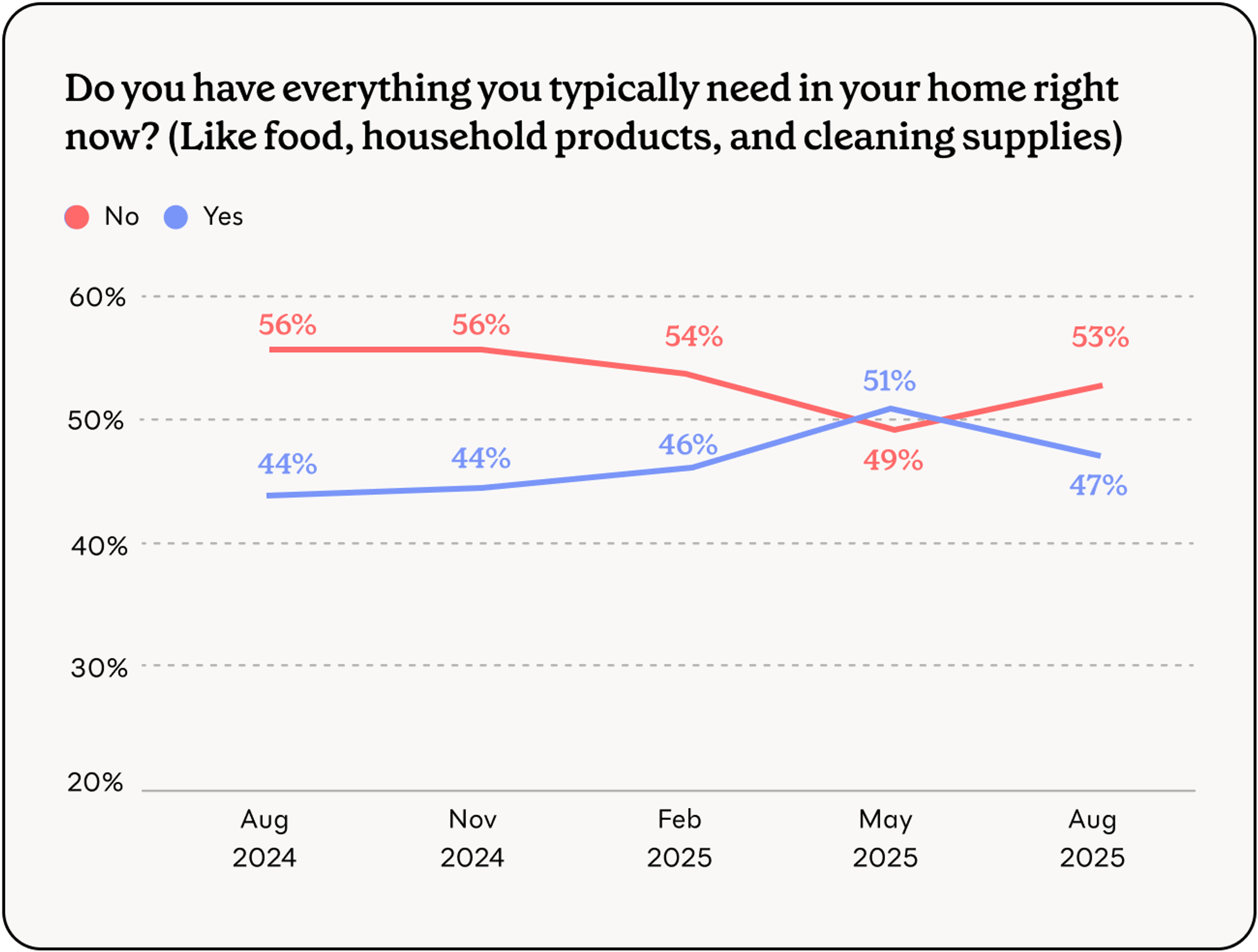

Household budgets remain under intense strain, with two-thirds of respondents reporting less than $25 in cash on hand and over half saying they lack basic household necessities. Late payments on utilities and housing remain widespread and well above last year’s levels, while a notable share of households continue to double up due to unaffordable rent or mortgage costs.

- 65% of respondents have less than $25 in cash on hand, a percentage that has risen for the third straight quarter and is approaching August 2024’s all-time high of 66%.

- 53% say that they do not have everything they typically need in their home right now, a 7% increase from May 2025 and a reversal of the past two quarters of positive news in this category.

- 40% paid their utility bill late in the past 30 days, the same percentage as May but up 58% from last August.

- 26% paid their rent or mortgage late, virtually unchanged from May and up 67% from last August.

- 10% moved in with others because they could no longer afford their rent or mortgage, only slightly lower than May.

“I have allowed several family members to temporarily live with me because they simply do not make enough money to pay rent. I was on the verge of eviction myself and needed any additional financial support.” – Chanae, Michigan

Borrowing & Debt#borrowing-and-debt

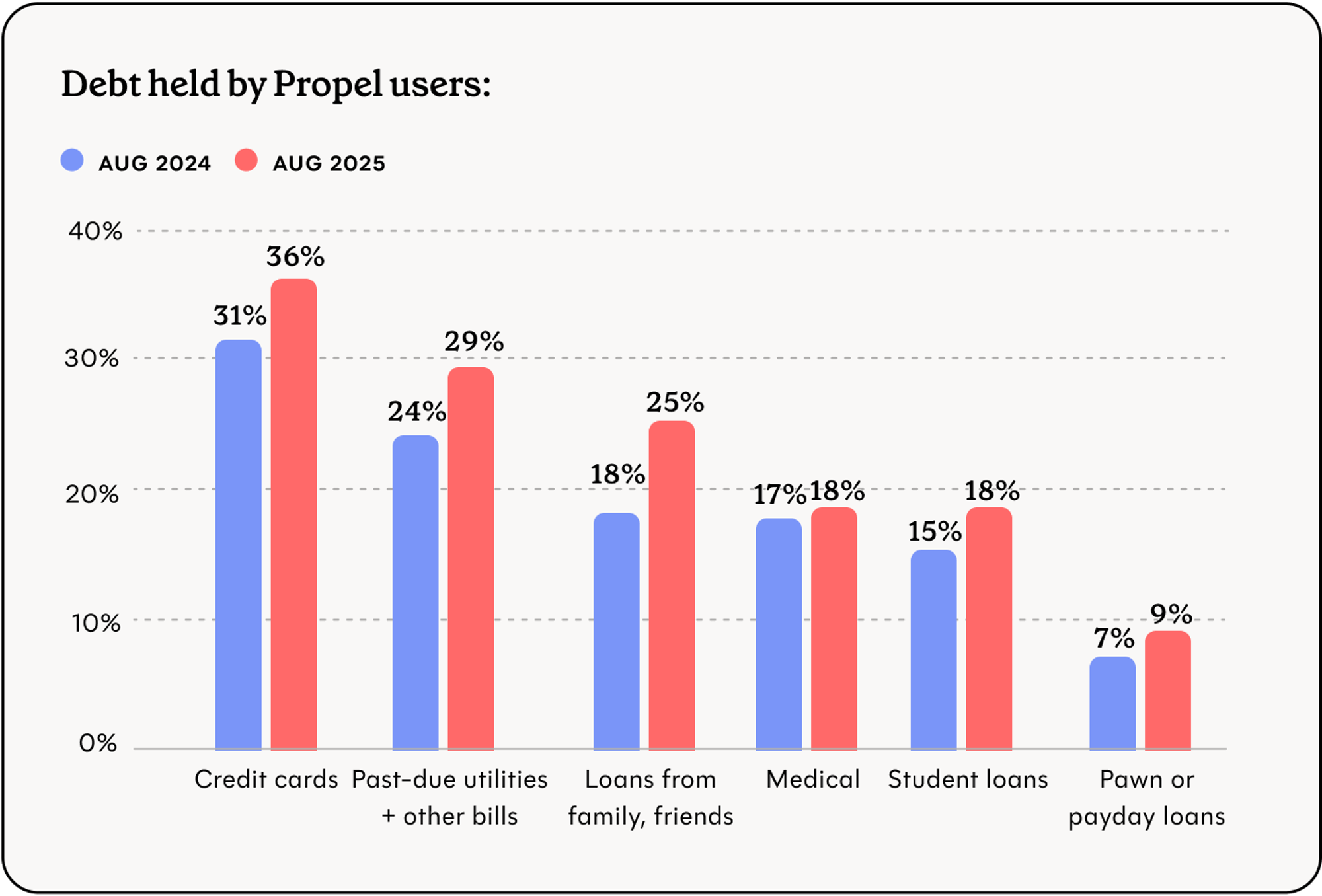

Household debt remains high, with more than a third of respondents carrying credit card debt and nearly a third behind on utilities or other bills. Borrowing from friends and family continues to rise, student loan debt is climbing fastest among adults 35-44, and payday or pawnshop loans remain common, underscoring the increased reliance on high-cost or informal credit to make ends meet.

- 36% of respondents report having credit card debt, the same percentage as May 2025 but up 16% from August 2024.

- 29% have debt from past-due utilities and other bills, virtually unchanged from May but up 23% from last August.

- 25% owe money to friends and family, a percentage that has risen for three straight quarters and is now 38% higher than last August.

- 18% have student loan debt, up 10% from May and 18% from last August. The most impacted cohort by far are respondents age 35-44, of whom 34% report having student loan debt.

- 18% have medical debt, down slightly from May but up 5% from last August.

- 10% took out a payday or pawnshop loan in the last 30 days, the same percentage as May but up 9% from last August.

“Usually I'm the one always helping others even if it's just a hot meal, but recently I had to beg to borrow money from a family member just so I could afford a motel room to have a place to lay my head for the night and access to a shower.” – Bo, Maryland