Can an app make a positive impact on an EBT cardholder’s overall financial health?

A recent survey shows that the majority of users see an improvement in their overall financial wellbeing as a direct results of using the Propel app.

We worked with research firm 60 Decibels, experts in social impact insights, to measure how the Propel app impacts its users' finances. 60 Decibels conducted 10-minute phone surveys with a random sample of 50 Propel users in November 2023. All respondents are EBT cardholders.

BEYOND TRANSACTIONS#beyond-transactions

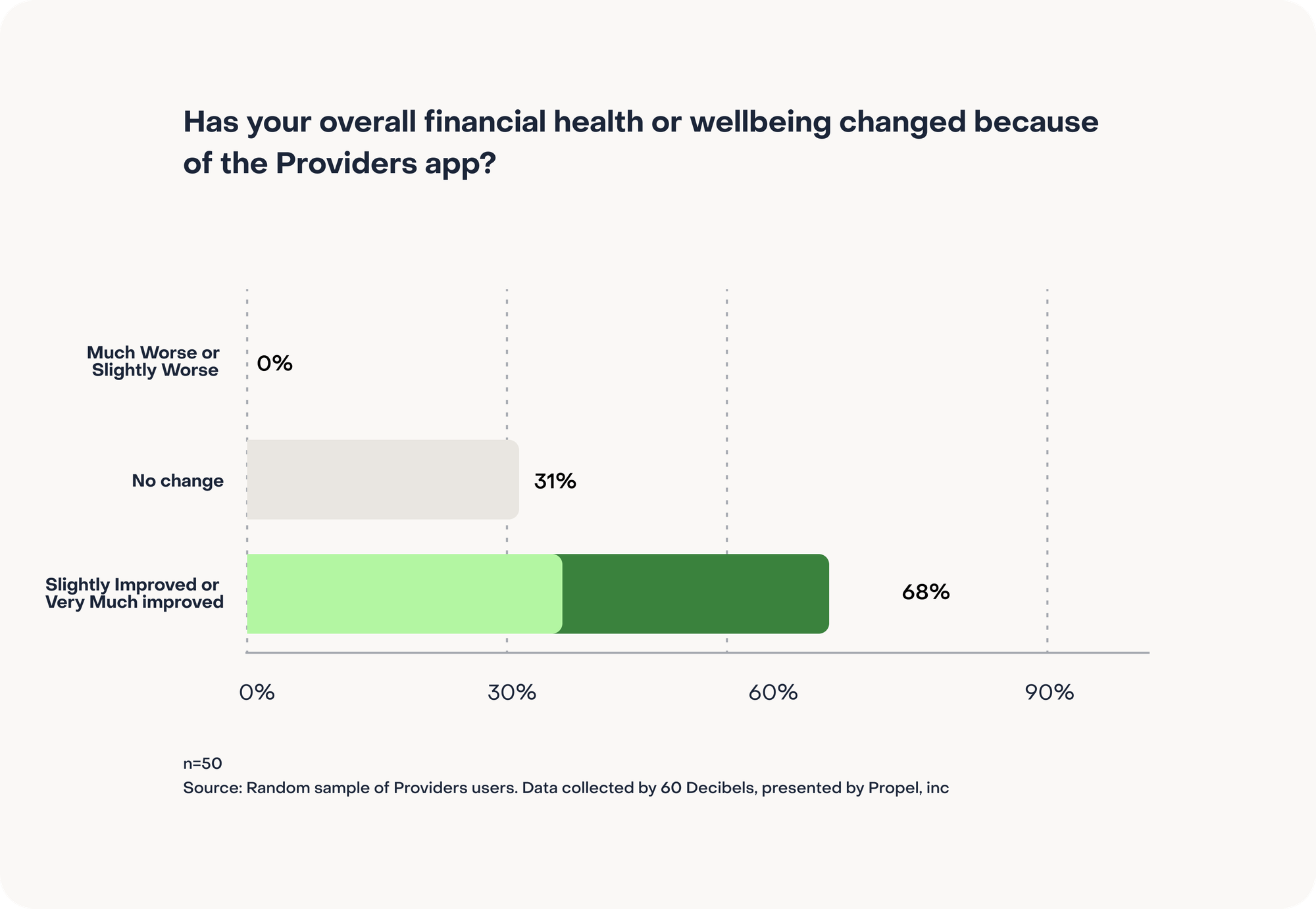

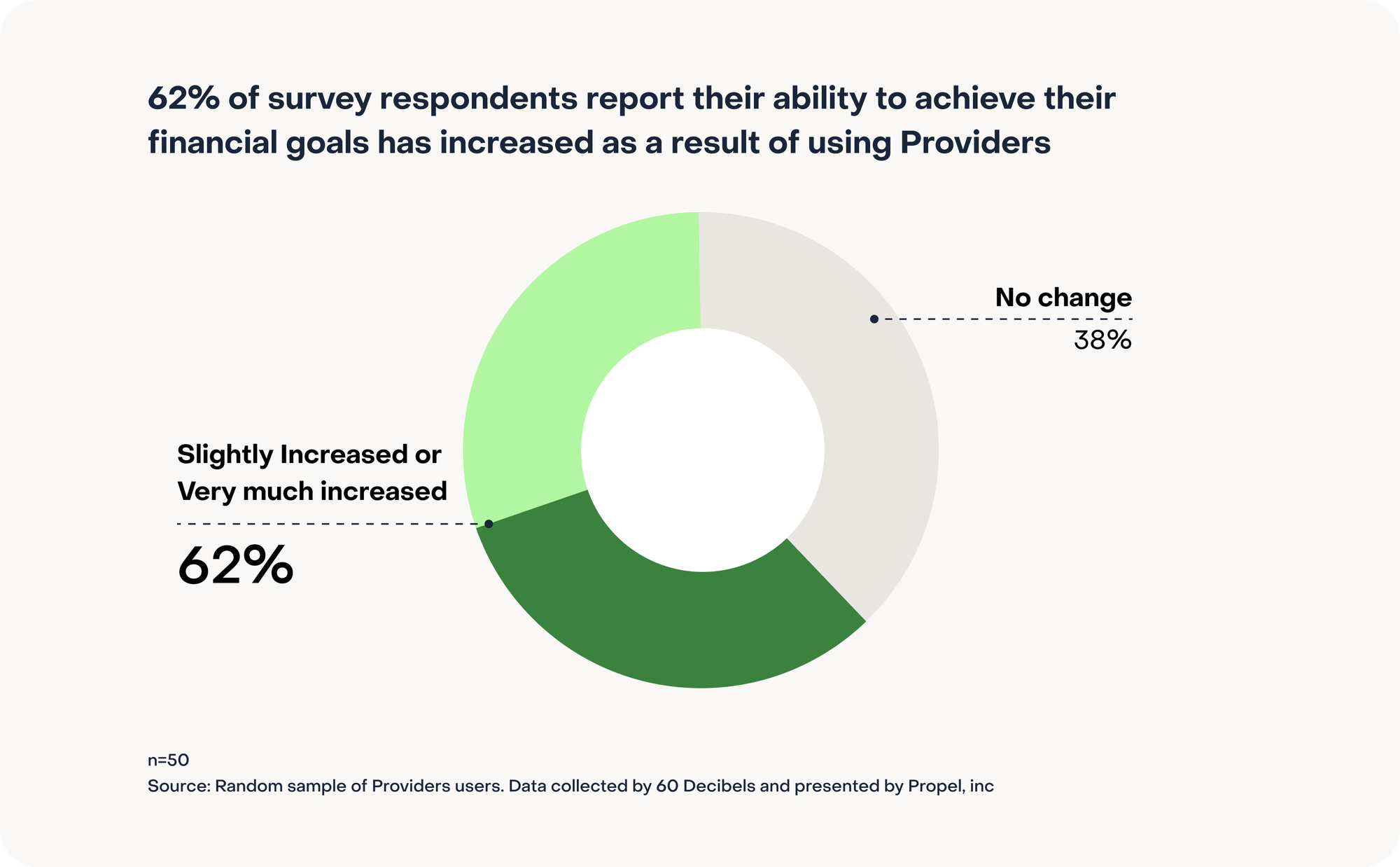

Survey reveals improvement in financial health for 68% of Propel app users#survey-reveals-improvement-in-financial-health-for-68-of-propel-app-users

- The most frequently mentioned driver of this improvement is financial empowerment (22% of survey respondents).

- Half of the users report that the time spent worrying about finances has decreased, and 40% report that their savings have increased.

- Relatedly, 60% of users report an increase in their sense of control over their finances.

Propel users appreciate how the app saves them time, money, and hassle:

“Now I am able to know what I am spending in the store, make better healthy choices. I can do things I was not able before because they have coupons to the stores I go to.”

“I am able to see my food stamps and direct deposit at the same time. It is easy to save on the Propel app.”

“The app makes managing my finances easier, all in one place.”

APP LOVE#app-love

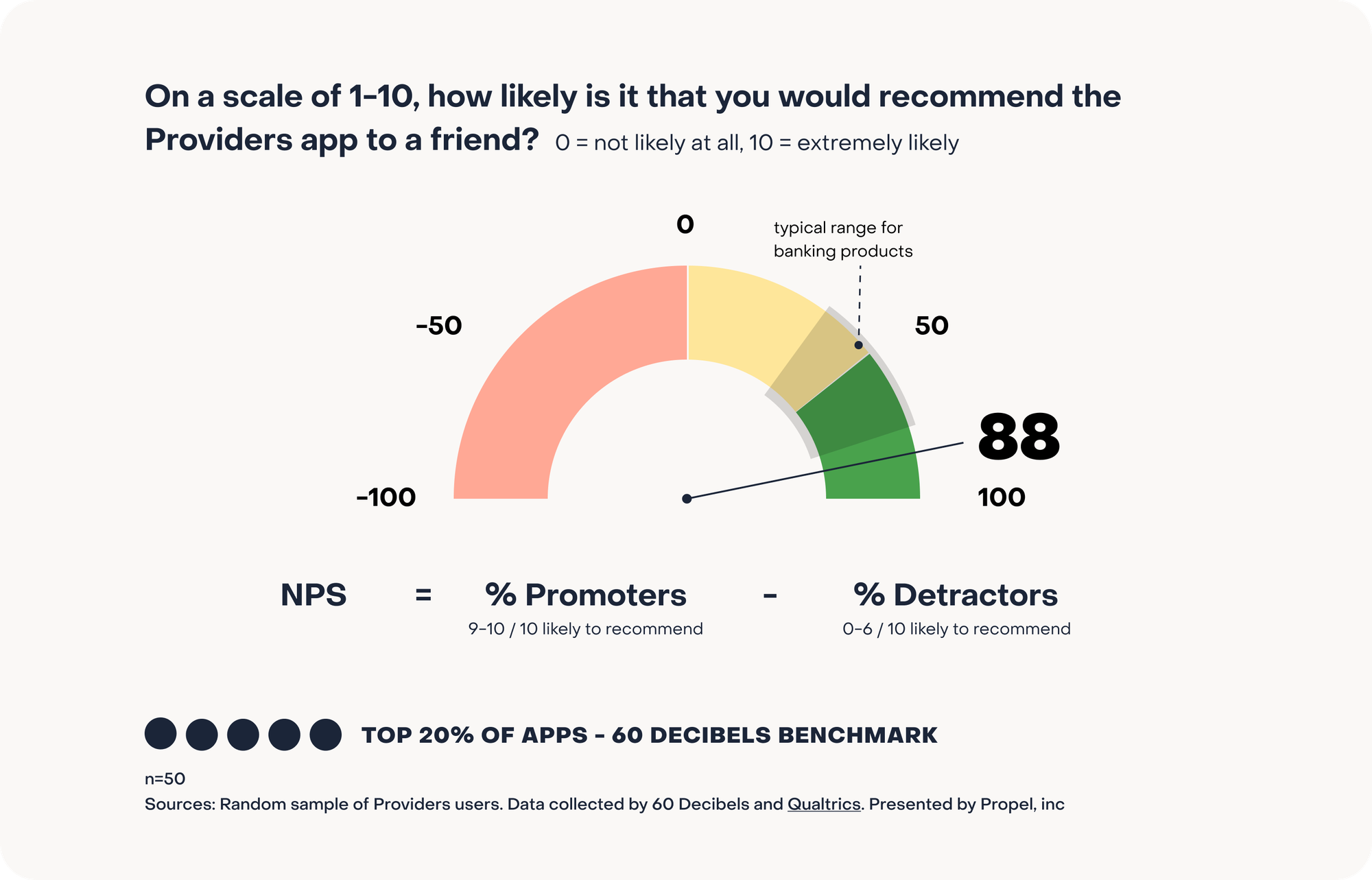

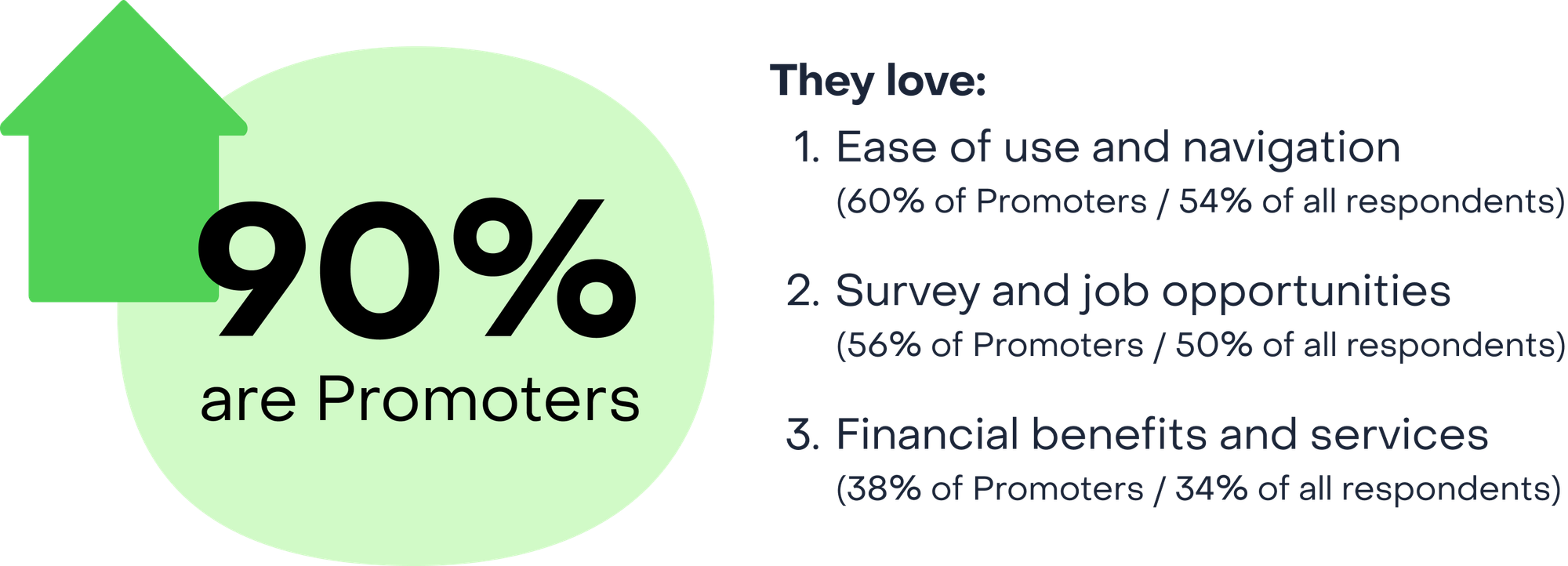

Propel scores big on user satisfaction#propel-scores-big-on-user-satisfaction

The Propel app has a Net Promoter Score (NPS) of 88. NPS is a measure of satisfaction and loyalty. This score is in the top 20% in 60 Decibels’ research database*, and surpasses the typical 40-75 NPS range for banking products, based on 2020 Qualtrics data.

*Sample includes 681 companies, 70 countries, 270,646 respondents.