December 2025 Pulse Survey

Summary

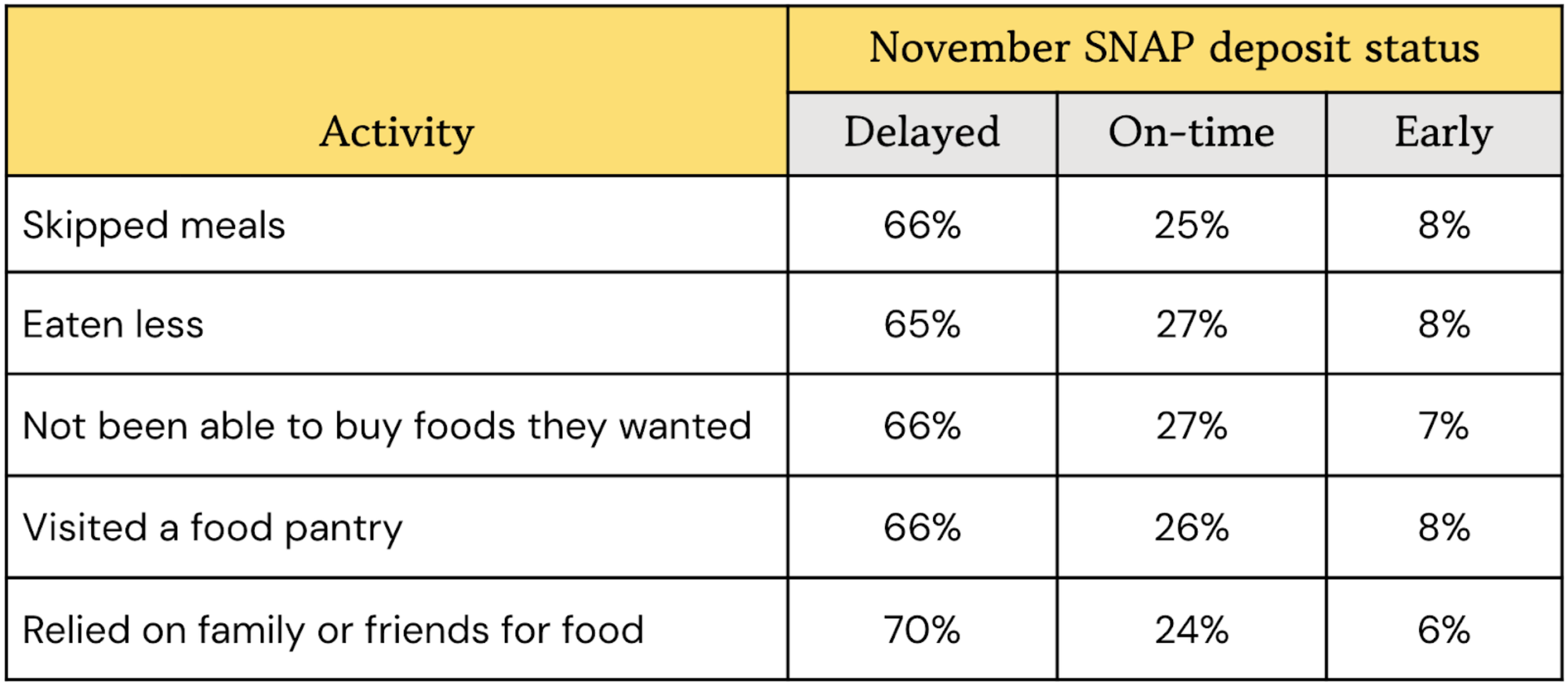

Households overall reported less food insecurity in December, but households that experienced SNAP delays in November were more than twice as likely to report skipping meals, eating less, visiting a food pantry, or relying on friends and family for food. More households also say their finances are stretched thin.

The following insights come from a <10-minute multiple choice and open response survey conducted by Propel. This month, responses came from 5,785 randomly selected households out of more than 5 million Propel users from December 2-4, 2025. All respondents are EBT cardholders.

Shutdown Impact#shutdown-impact

These survey results capture the immediate aftermath of the November 2025 government shutdown, a period marked by both short-term relief and lingering harm. While overall food insecurity declined in early December as delayed SNAP benefits were restored and new deposits arrived, households that experienced November payment delays reported sharply worse outcomes – revealing how delayed SNAP payments have outsized effects on household perceptions of well-being.

Food Insecurity#food-insecurity

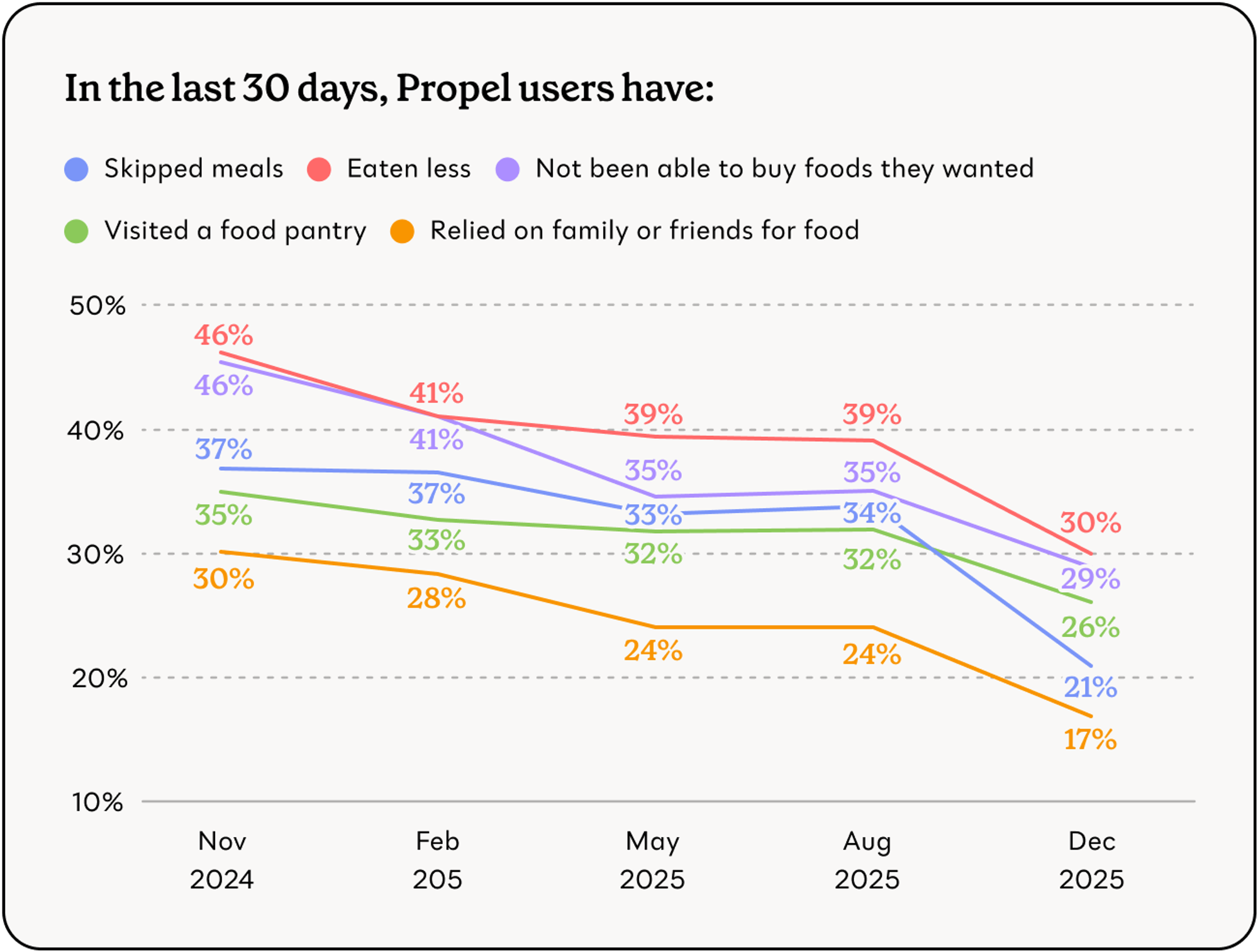

Overall, households in our survey reported a significant decrease in food insecurity in December, with cases of skipping meals, eating less, and worrying about how long food would last each down by nearly 10 percentage points compared to August 2025.

However, the data tell a more nuanced story, reflecting the differing experiences of households during the government shutdown and the resulting delay in SNAP deposits. As part of this survey, Propel asked respondents about their November SNAP deposit status – 57% said their November SNAP deposit was delayed, while 33% received it on time, and 9% received it early.

Survey respondents who received on-time or early deposits reported dramatically lower levels of food insecurity – perhaps reflecting a rare moment of relative stability. Households who experienced delayed SNAP deposits reported a huge spike in skipped meals, food pantry visits, and reliance on family and friends to get by. This evidence underscores the foundational role of SNAP in supporting household well-being.

“We had to ration what food we had, and when we bought food, we had to get the cheapest and hopefully the most filling, and just go day by day.” – Sonya, Florida

Financial Insecurity#financial-insecurity

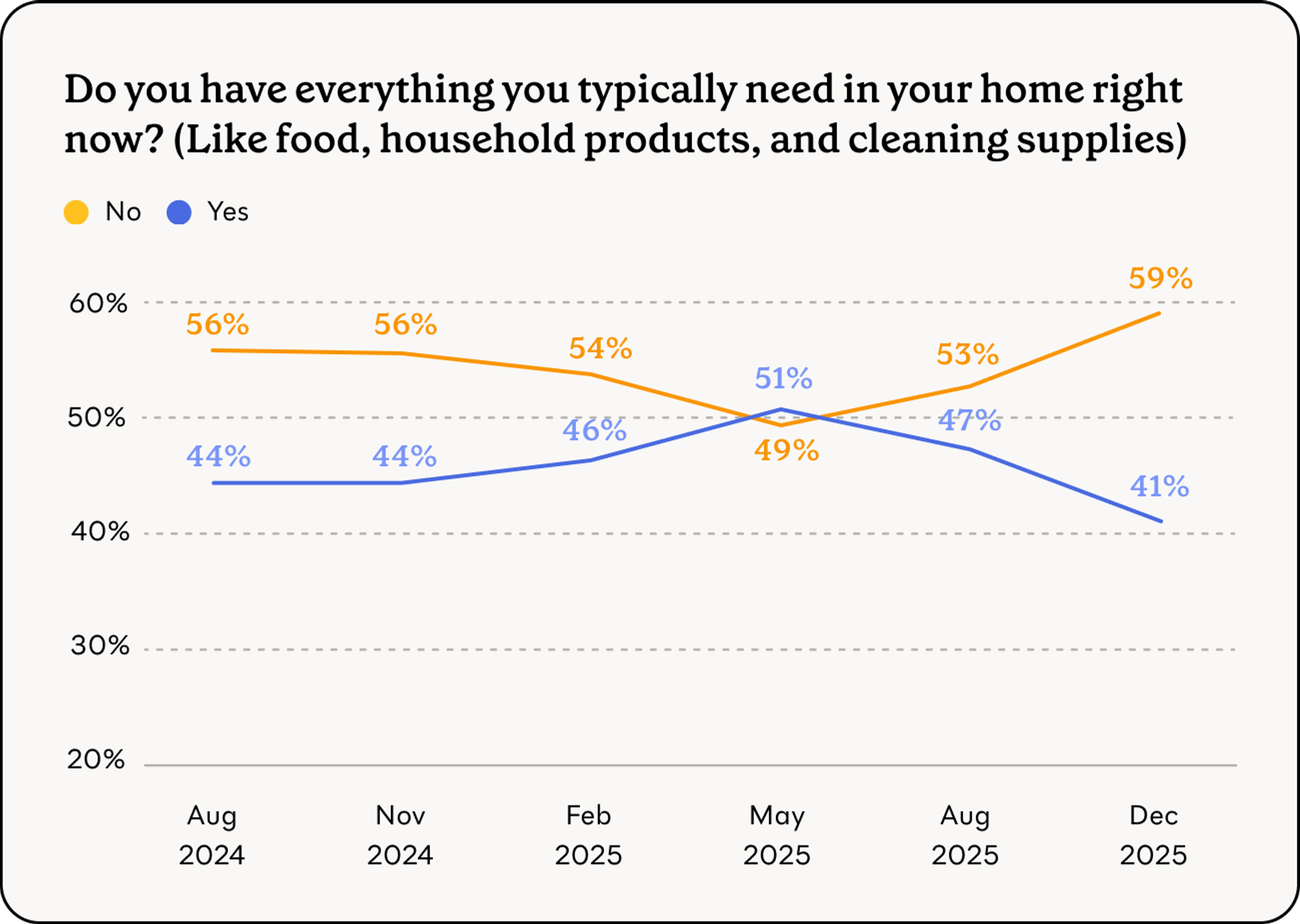

Despite households reporting less food insecurity in December, more households say their finances are stretched thin. Nearly 60% report lacking basic household essentials and about the same percentage have less than $25 in cash on hand – levels that have remained stubbornly high over time. While late utility payments declined somewhat since August, missed or delayed rent and mortgage payments increased, underscoring ongoing housing instability even as some expenses may have eased temporarily.

- 59% of respondents say they lacked household essentials, a sharp rise from 53% in August and 49% in May.

- About 60% say they have less than $25 in cash on hand, a percentage that has barely moved in the past two years.

- 33% paid utility bills late, down 7 percentage points from August (40%) but still relatively high compared to February (24%).

- 31% say they paid their rent or mortgage late, up 5 percentage points from August (26%).

“It has had a huge impact on my family…Currently trying to decide whether to push back a few bills or buy a few food items. Christmas definitely isn't gonna happen this year either.” – Jessica, North Carolina

Borrowing & Debt#borrowing-and-debt

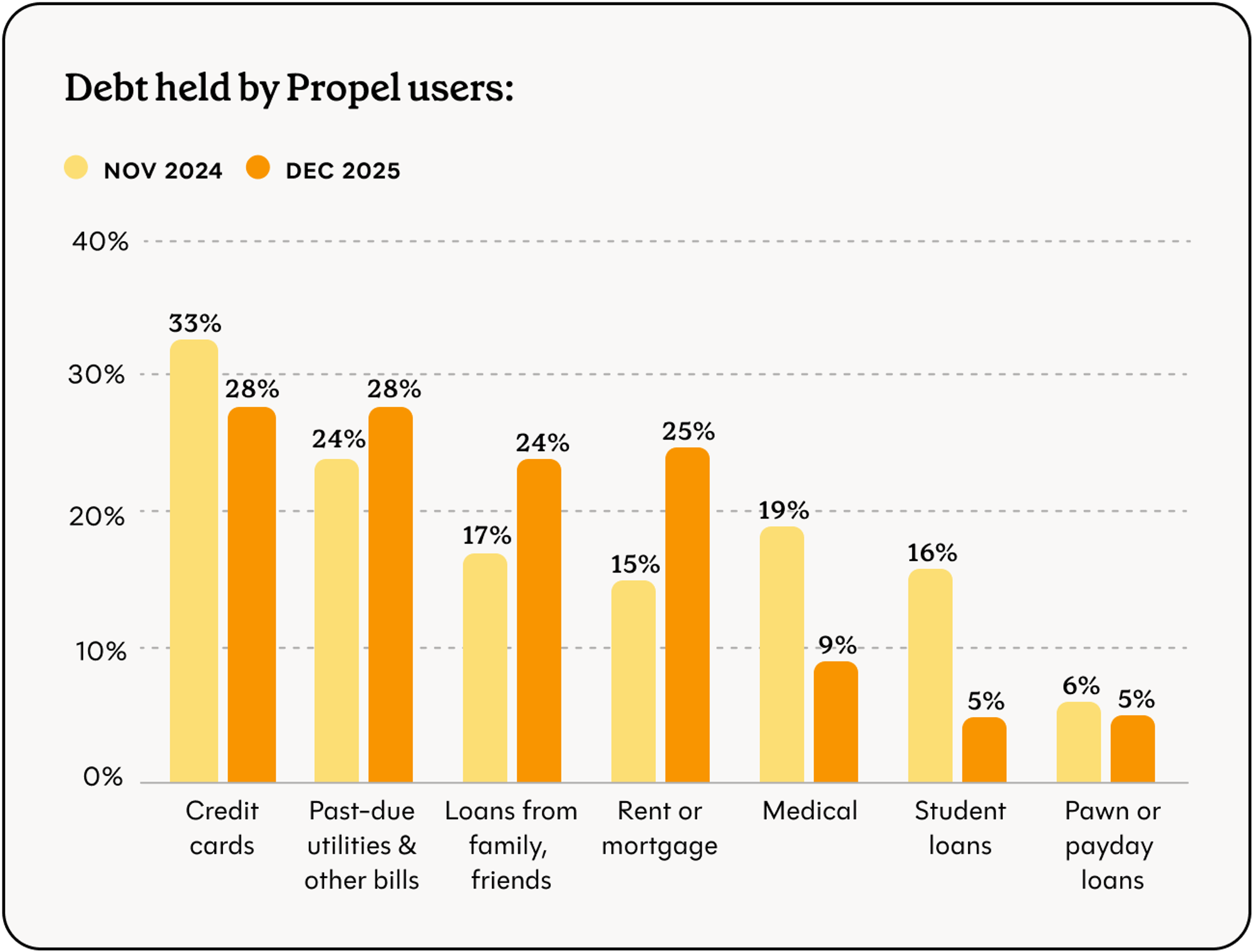

Household debt reported by survey respondents also shows a mixed picture. Reliance on high-cost debt appears to be easing, as fewer respondents report using payday or pawn shop loans and credit card debt has fallen substantially since August. At the same time, more households are leaning on informal and deferred forms of borrowing – such as owing money to family and friends and using buy-now-pay-later services – suggesting that financial strain persists and is increasingly being managed through less visible but still risky debt.

- 28% of respondents have debt from past-due utilities and other bills, a slight decrease from earlier in the year but 6 percentage points higher than February.

- 28% have credit card debt, down from 36% in August but similar to the percentage in February (30%).

- 24% owe money to family and friends, a 5 percentage point increase from February (19%) and 7 percentage point increase from last November (17%).

- 8% took out a payday or pawn shop loan in the last 30 days, down from 10% in August. Respondents who report having debt from payday or pawn shop loans also fell from 9% in August to 5% in December.

“Got behind on bills, used bill funds for groceries. Now I'm behind and may lose electricity service because I'm having trouble catching up.” – Markus, Arizona