May 2025 Pulse Survey

Summary

Improved access to food masks deeper instability – low-income families are increasingly unable to afford housing, healthcare, and bills.

The following insights come from a <10-minute multiple choice and open response survey conducted by Propel. This month, responses came from 3,003 randomly selected households out of more than 5 million Propel users from May 1 - 14, 2025. All respondents are EBT cardholders.

Food Insecurity#food-insecurity

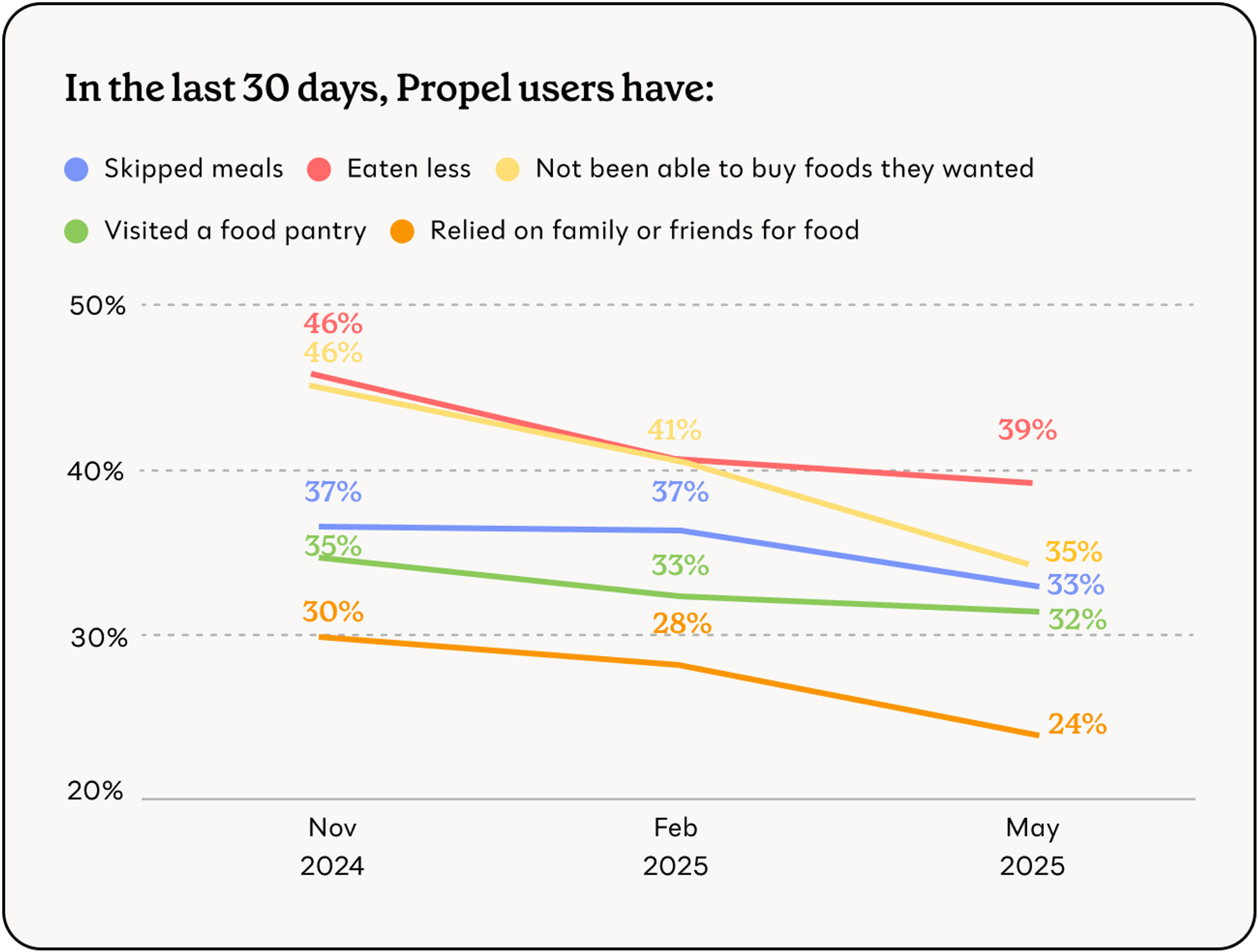

Households were slightly more food secure in May than they were in previous months. For the third straight quarter, respondents reported fewer skipped meals, less reliance on friends and family for groceries, and fewer visits to the food pantry. However, nearly a third of respondents still rely on food pantries each month to feed their household, and over half are not sure if the food they have will last.

- 50% said they are worried that their food will run out before they can buy more.

- 39% reported eating less in the last 30 days, a 4% decrease since February and the third straight quarter of decline.

- 35% were not able to buy the kinds of food they wanted, a 16% decrease since February and the third straight quarter of decline.

- 33% reported skipping meals, a 9% decrease since February and the third straight quarter of decline.

- 32% visited a food pantry in the last 30 days, a modest decrease from February.

- 24% relied on family or friends for food, a 15% decrease since February and the third straight quarter of decline.

“My daughter helps me out sometimes with some groceries. She can't help me all the time because she has her own children. I just don't eat sometimes.” – Alfreda, Minnesota

Financial Insecurity#financial-insecurity

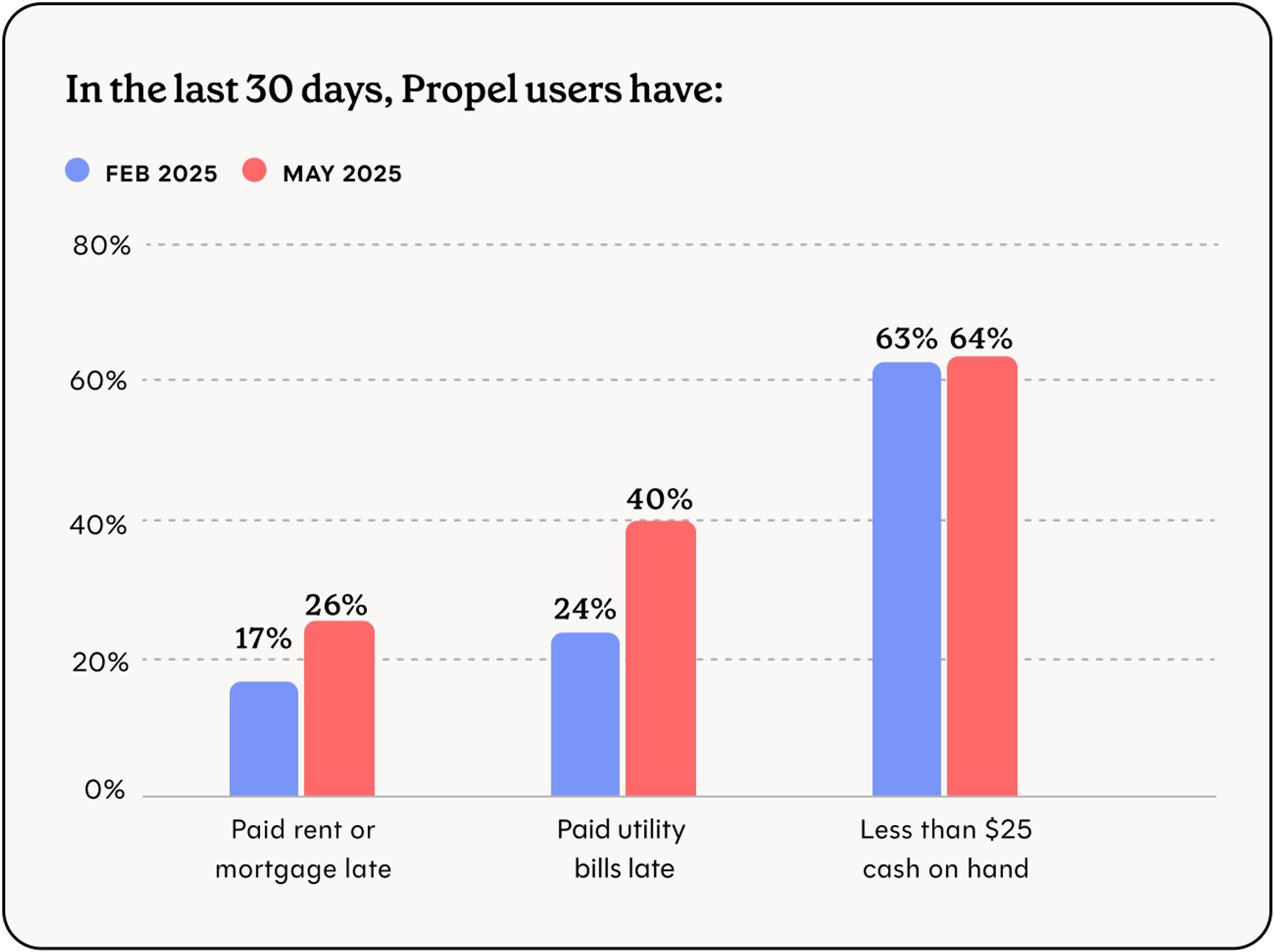

Household finances continue to buckle under the high cost of living, particularly when it comes to housing. The percentage of respondents who paid their rent or mortgage late jumped significantly in May, as did respondents who paid their utility bills late. A majority of respondents still report having less than $25 in cash on hand, making it very difficult for households to get ahead financially.

- 40% paid their utilities late in the past 30 days, a 52% increase from February.

- 26% paid their rent or mortgage late, a 69% increase from February.

- 16% skipped doctor visits or trips to the hospital because of the cost.

- 13% went without prescription medicine due to the cost.

- 11% moved in with others because they could no longer afford their rent or mortgage.

- 64% said they have less than $25 in cash on hand, slightly higher than February but largely unchanged from a year ago.

- 51% say they have everything they typically need in their home right now, a 9% increase from February.

“Sister has moved in due to being evicted and no place else to live and I only get $108 a month for food which is basically $22 a week to feed us both. Can't even feed myself on that. I think that's pretty rotten.” – Kathy, Florida

Borrowing & Debt#borrowing-and-debt

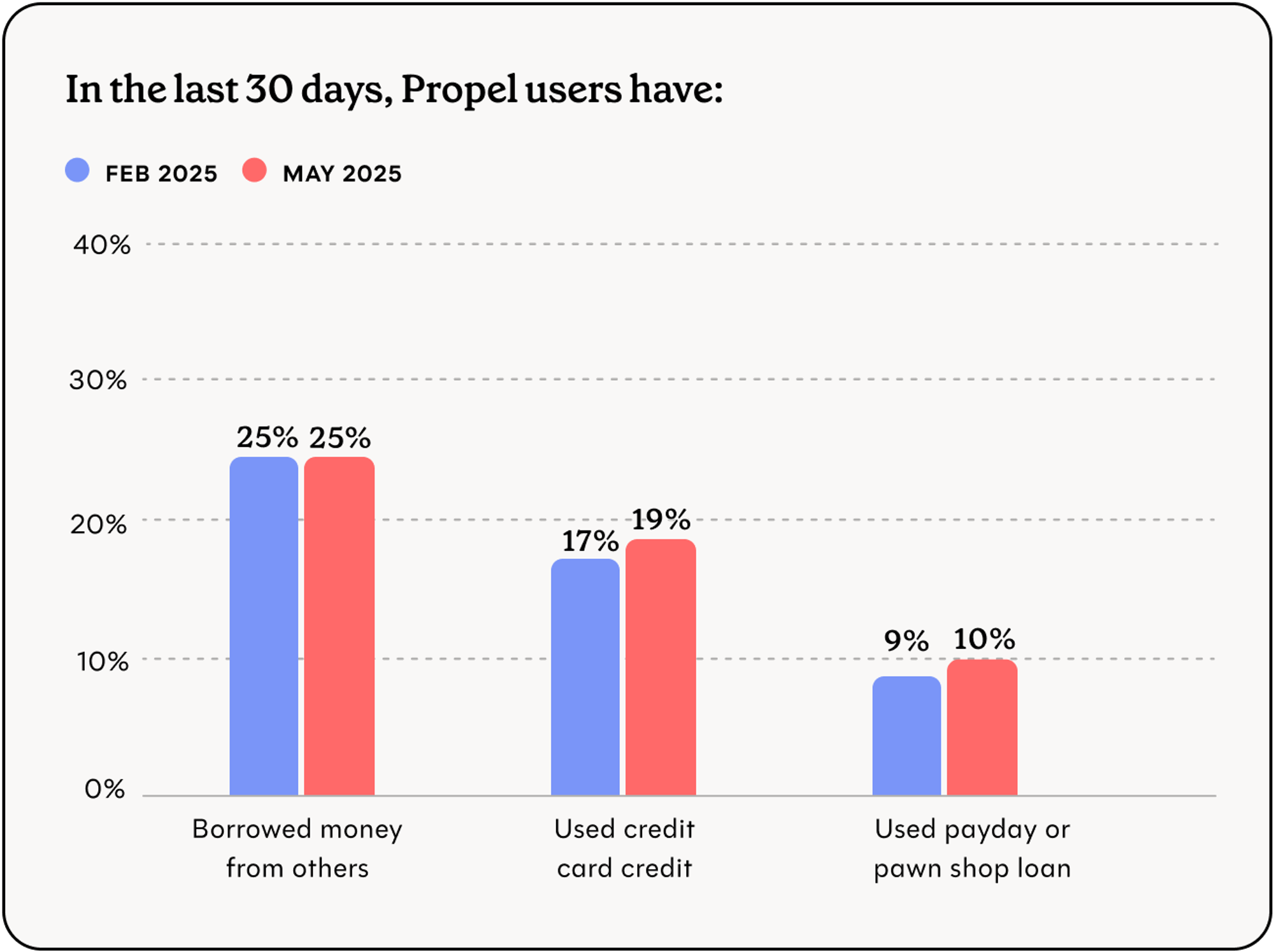

As further evidence of the financial strain facing low-income households, a slightly higher percentage of respondents in May reported borrowing money or taking on debt to buy what they needed. Meanwhile, the percentage of respondents with debt from rent, past-due utilities, and credit cards remains relatively high.

- 25% borrowed money from family and friends to cover monthly expenses, virtually unchanged from February.

- 19% used a credit card, a 12% increase from February.

- 10% took out a payday or pawn shop loan, a 25% increase from February.

- 36% report having credit card debt.

- 31% report having debt from past-due utilities.

- 23% report having rent or mortgage debt.

“I’ve had to have major help with bills and groceries from family members and churches along with visits to food pantries. I’m getting deeper into debt just for trying to make ends meet.” – Virginia, Alabama