Data insights: October 2025 EBT theft trends

Return to Propel's EBT Theft Hub

Key findings#key-findings

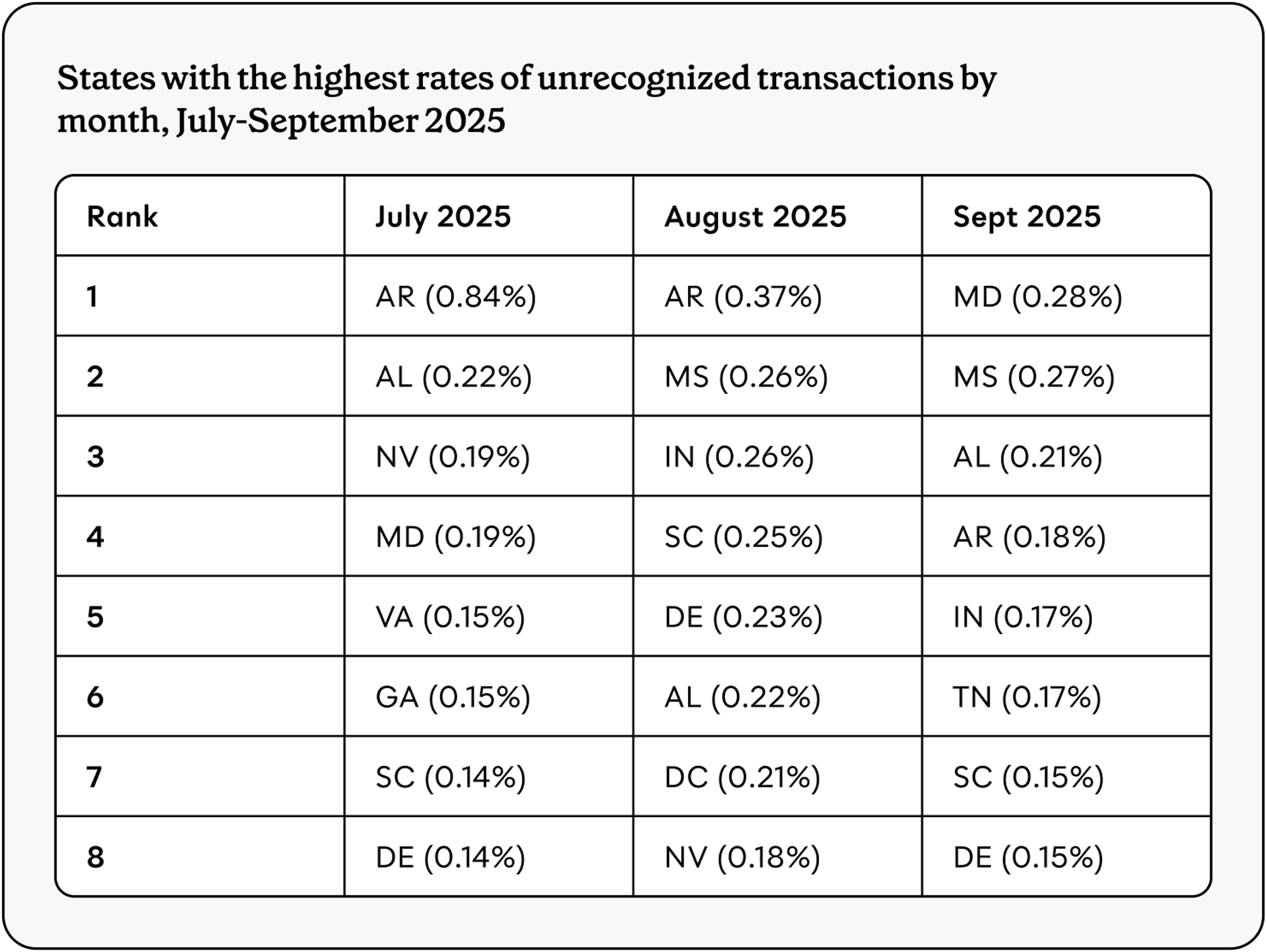

- Theft decreased in most states highlighted in September 2025.

- New York saw a significant increase in theft volume, but the per-recipient rate remains low.

- Maryland experienced a large increase in the percentage of recipients experiencing theft, this increase primarily targeted cash benefits, as opposed to SNAP benefits.

- Skimming activity has eased since August, even as repeat shoppers are still targeted in Mississippi and Alabama and Indiana shows signs of ongoing theft.

Propel’s theft detection capabilities#propels-theft-detection-capabilities

Propel serves over 5 million EBT cardholders nationwide who use our app to manage their benefits every month. We analyze transaction and customer-reported data to identify emerging theft patterns through a two-step detection process. First, we identify retailers with unusually high rates of transactions flagged as "unrecognized" by Propel users. These are retailers where stolen benefits appear to be drained or liquidated. Second, we identify skimmer locations by analyzing victims’ shopping patterns in the 8-12 weeks prior to their card being liquidated.

Our insights are intended to provide a snapshot of emerging trends in EBT theft. We generate these analyses early in the month, when theft activity typically peaks following SNAP benefit deposits. Our data reflects real theft activity, but may show a slight upward bias since cardholders are more likely to check the app after experiencing theft. Given the rapidly evolving nature of EBT theft, our insights represent a current snapshot rather than a comprehensive assessment.

Recent theft patterns and spikes#recent-theft-patterns-and-spikes

New York continues to have the highest theft by volume due to its large population. Maryland saw a sharp rise in cash benefit theft beginning in early September, with no clear statewide pattern and no individual skimmers yet identifiable. Mississippi, Indiana, and Alabama remain top theft states, but skimming linked to a specific retail chain has declined since August, suggesting that many skimmers may have stopped operating. However, repeat shoppers in Mississippi and Alabama are still being hit and Indiana shows signs that skimming may be continuing.

New York theft volume increase#new-york-theft-volume-increase

Despite a 46% increase in fraudulent transactions from August to September, New York ranks 16th in September fraud per capita. New York theft continues to take place at liquidators claiming to be in New York State. Unlike New York theft spikes over the summer, September theft isn’t concentrated among users in the New York City area.

Maryland theft exclusive to cash benefits#maryland-theft-exclusive-to-cash-benefits

All identified Maryland theft came from cash benefits rather than SNAP. The vast majority of cash benefits liquidation happened in Maryland at ATMs – 344 transactions across 23 locations.

The theft pattern isn’t consistent with statewide fraud (i.e., theft isn’t elevated across counties). Skimming could be the cause – the per user theft rate is highest in the city of Baltimore and elevated in surrounding Baltimore County. However, individual skimmers can’t be identified with high confidence at this time.

The increase in cash theft began in early September and has continued through early October.

Liquidation slows in Mississippi, Indiana, and Alabama#liquidation-slows-in-mississippi-indiana-and-alabama

These three states remained in the top five by theft rate this month. In August, a large portion of theft in each of these states could be tied to skimmers targeting a specific retailer. This pattern still exists in September and early October theft, but is less prevalent than it was in August.

Some locations of this retailer still have higher future victim liquidation rates than other popular chains, but volume isn’t as high as last month.

In Mississippi, six locations of this retailer had future liquidation victim rates of 15%+ (i.e., among users who shopped there, 15%+ later had their benefits stolen elsewhere) as opposed to 20 locations last month. Alabama fell from 11 locations to 9 and Indiana from 13 to 3.

All Mississippi locations of this retailer with high future liquidation victim rates in September also had high rates in August. In Alabama, six out of the nine locations with high future liquidation victim rates in September also had high rates in August. This means many of the skimmers may have ceased operation, but repeat shoppers at this chain are still being liquidated.

However, in Indiana, only one of the three locations with a high future liquidation victim rate in September also had a high rate in August, so it’s possible skimming continues there.

Ongoing support#ongoing-support

Propel is committed to supporting state and federal agencies in protecting SNAP recipients from EBT theft. For questions about our methodology or further analysis, please contact gov@joinpropel.com.