Data insights: September 2025 EBT theft trends

Our editorial promise

All of our Propel editorial content meets our high bar for accuracy, timeliness, trust, and relevance. Our pages are edited and fact-checked to make sure we meet our mission of giving you information you can rely on.

Learn more about our editorial standards.

Return to Propel's EBT Theft Hub

Key findings#key-findings

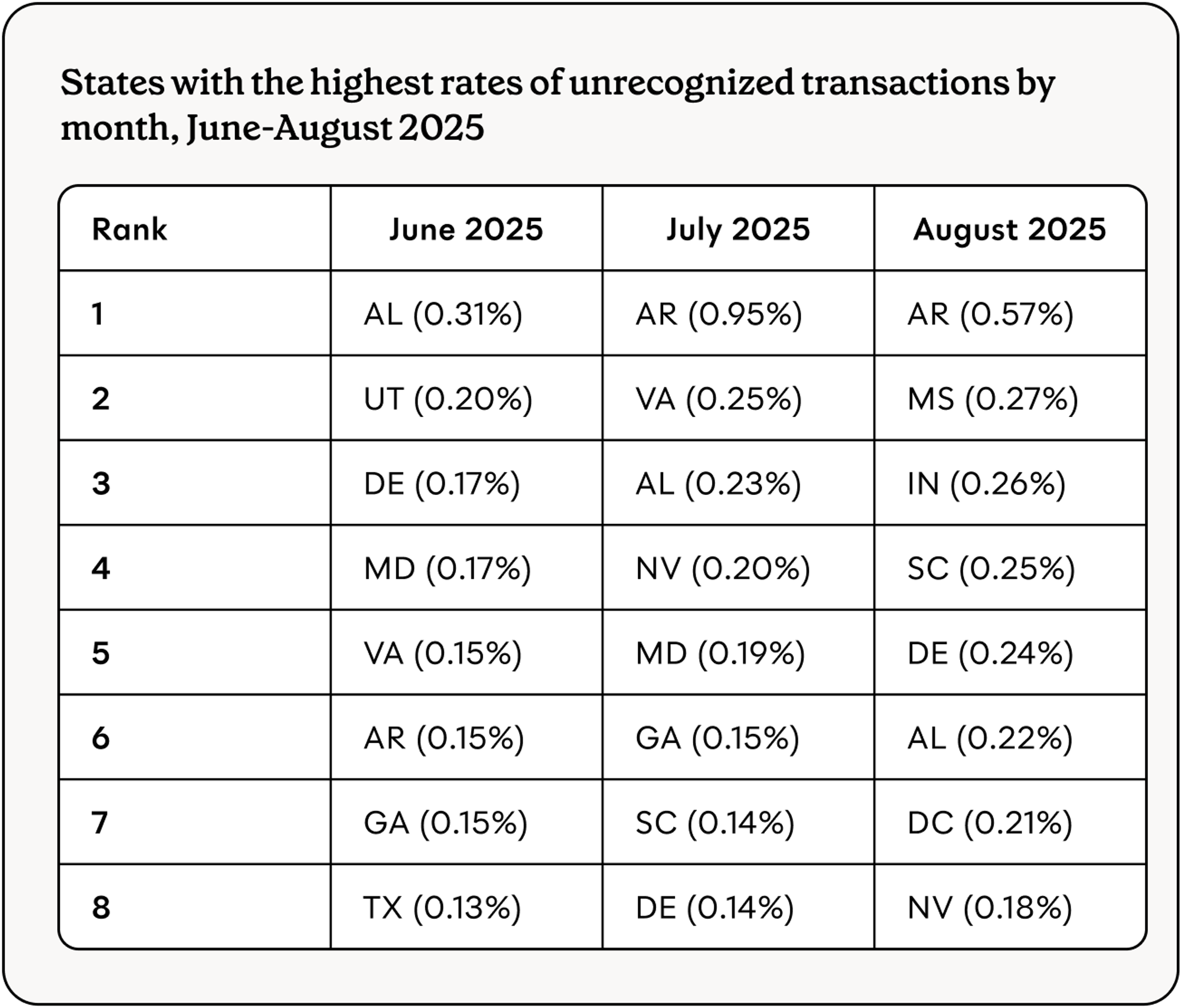

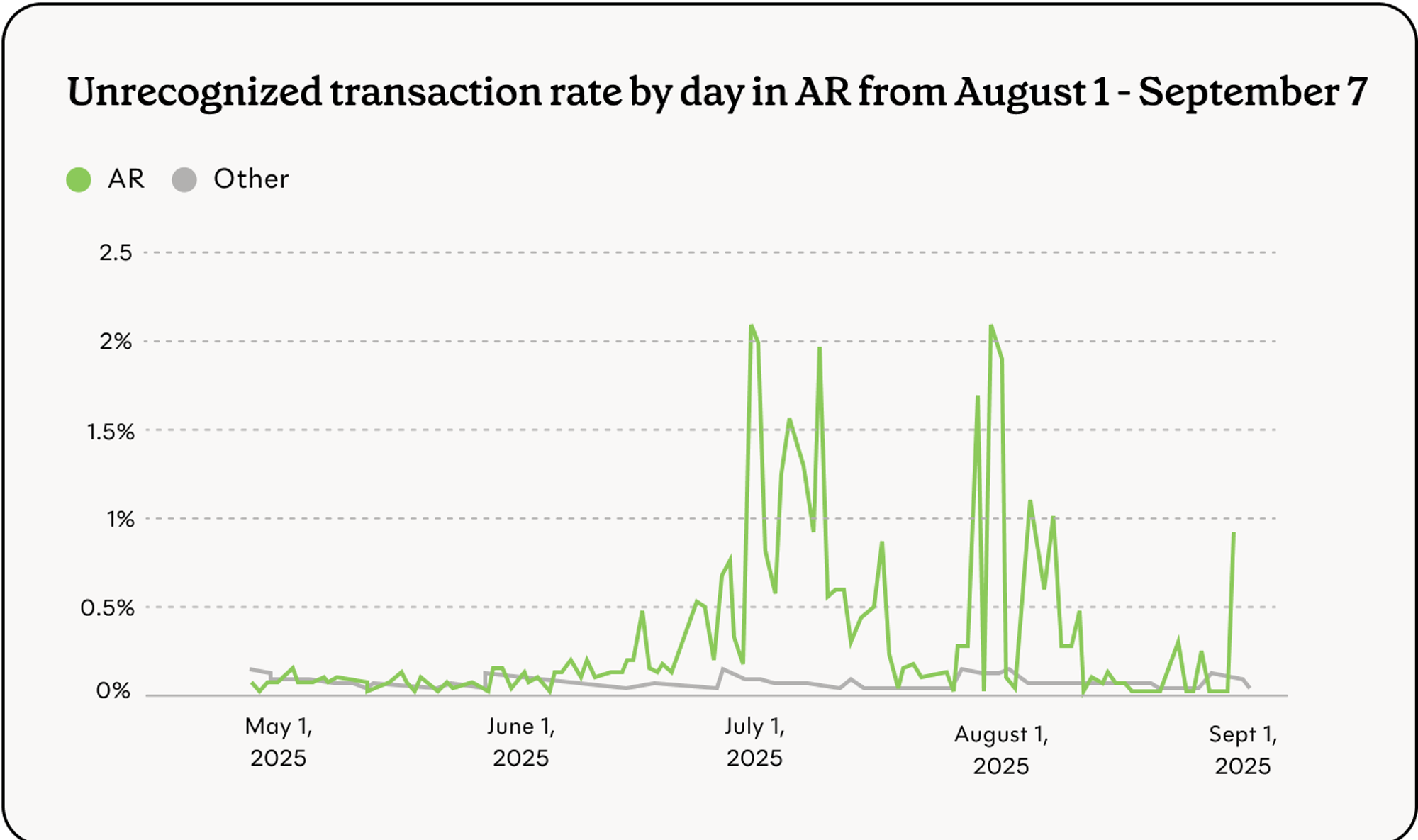

- The hot spot observed in Arkansas over the past several months cooled in the second half of August, and continued to be calmer into early September

- Mississippi and Indiana saw a large increase in skimming-powered activity, which appears to be tied to coordinated targeting of one specific chain of retail stores

- Alabama, Delaware, the District of Columbia, and South Carolina are seeing an increase in theft activity over the previous month.

Propel’s theft detection capabilities#propels-theft-detection-capabilities

Propel serves over 5 million EBT cardholders nationwide who use our app to manage their benefits every month. We analyze transaction and customer-reported data to identify emerging theft patterns through a two-step detection process. First, we identify retailers with unusually high rates of transactions flagged as "unrecognized" by Propel users. These are retailers where stolen benefits appear to be drained or liquidated. Second, we identify skimmer locations by analyzing victims’ shopping patterns in the 8-12 weeks prior to their card being liquidated.

Our insights are intended to provide a snapshot of emerging trends in EBT theft. We generate these analyses early in the month, when theft activity typically peaks following SNAP benefit deposits. Our data reflects real theft activity, but may show a slight upward bias since cardholders are more likely to check the app after experiencing theft. Given the rapidly evolving nature of EBT theft, our insights represent a current snapshot rather than a comprehensive assessment.

Recent theft patterns and spikes#recent-theft-patterns-and-spikes

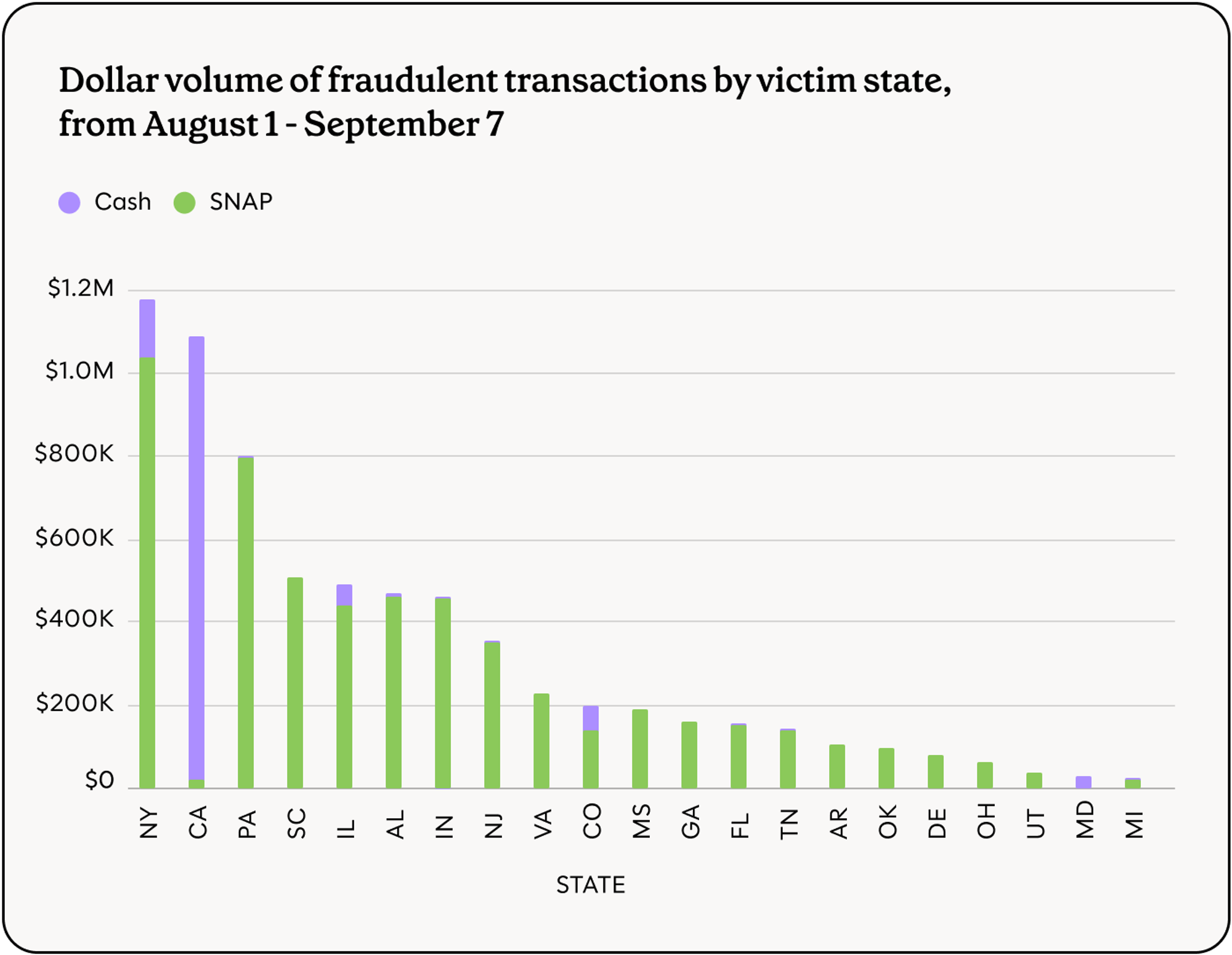

Arkansas theft dropped dramatically in mid-August, but it remained the top theft state due to activity earlier in the month. Mississippi and Indiana saw large increases in theft seemingly tied to skimmers targeting the same chain retailer.

Higher-population states typically account for more stolen benefits despite their lower theft rates. However, two smaller states, South Carolina and Indiana, had the 4th and 7th highest theft by volume last month because of their rising theft.

Skimming in Mississippi, Indiana, and Alabama#skimming-in-mississippi-indiana-and-alabama

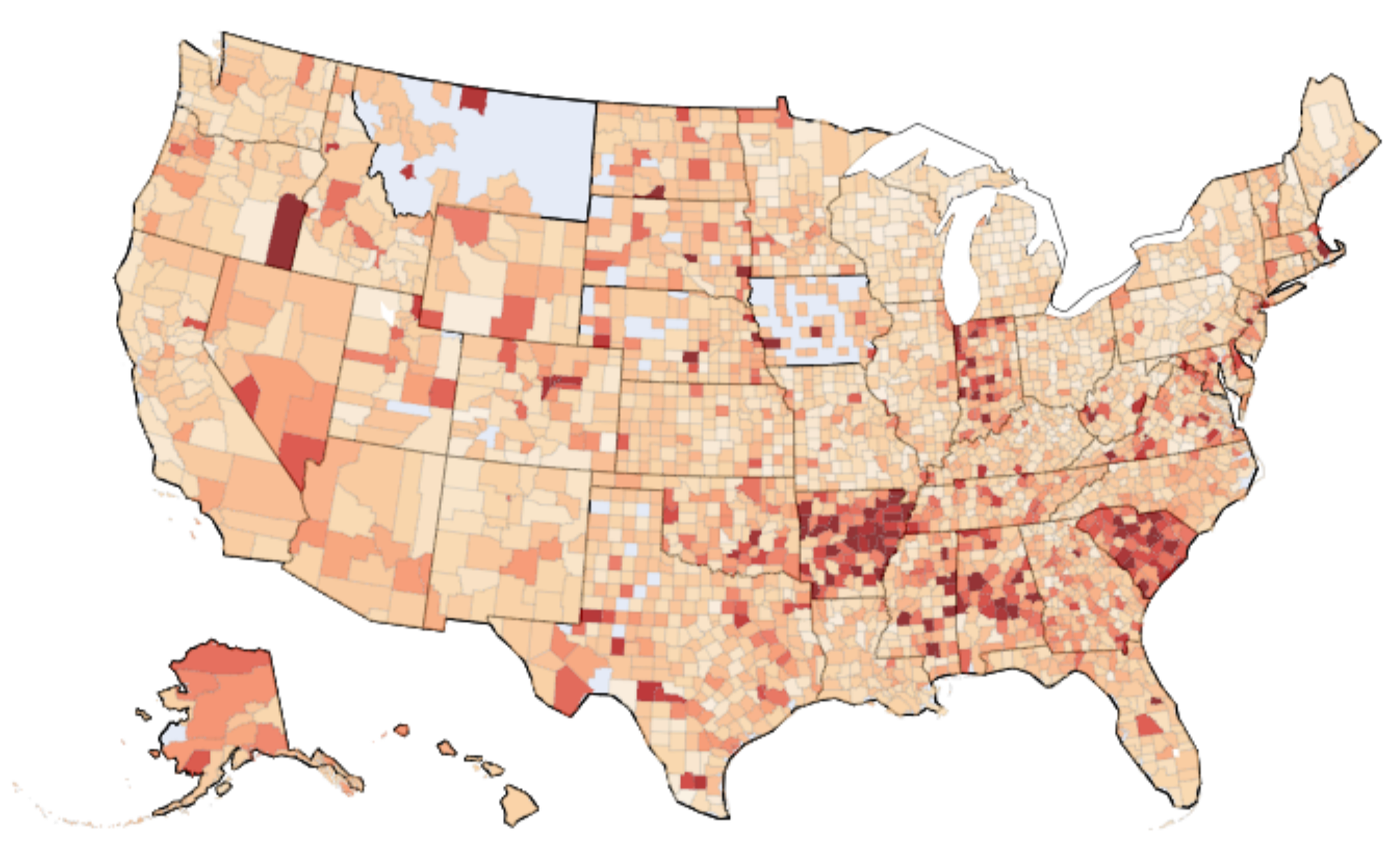

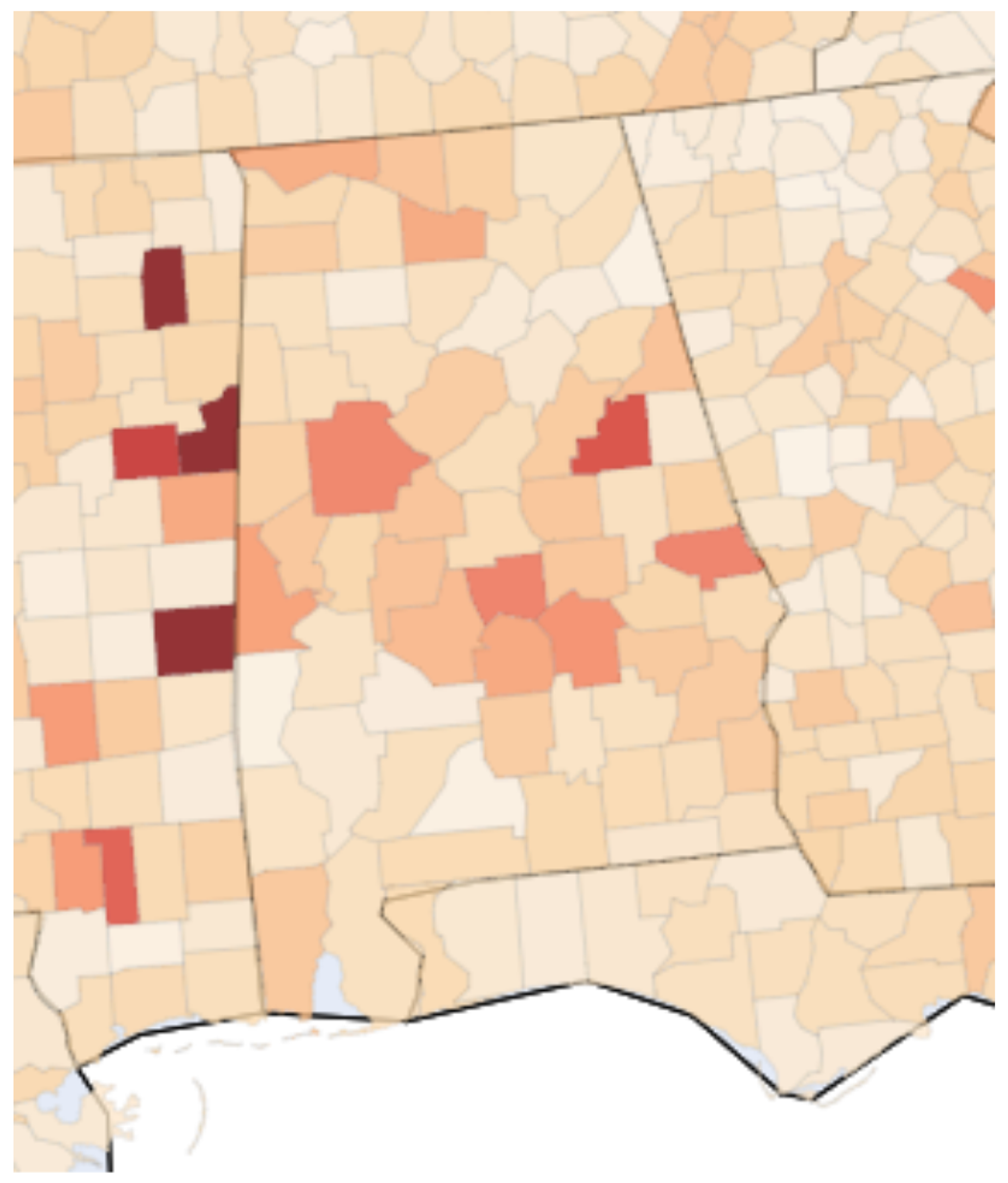

Mississippi, Indiana, and Alabama had some of the highest theft rates in August. The geographical pattern of the theft is consistent with skimming (isolated clusters of elevated rates) rather than a statewide card compromise or algorithmic attacks. In both states, users who were liquidated in August often had an earlier transaction at one of a set of stores from a specific retail chain. This trend is strongest in Mississippi, followed by Indiana and Alabama.

Mississippi#mississippi

For example, of 103 users that shopped at a specific retail location in Lauderdale County, MS, 49% later had their benefits stolen. 8% of users in Lauderdale County marked a transaction unrecognized August 1 - September 7.

20 different stores in Mississippi from the same retail chain had future liquidation victim rates of 15%+ (i.e. among users who shopped there, 15%+ later had their benefits stolen elsewhere). 91% of Mississippi users with stolen benefits in this period shopped at one of these stores. Liquidation often took place at retailers purporting to be in Pennsylvania and New Jersey.

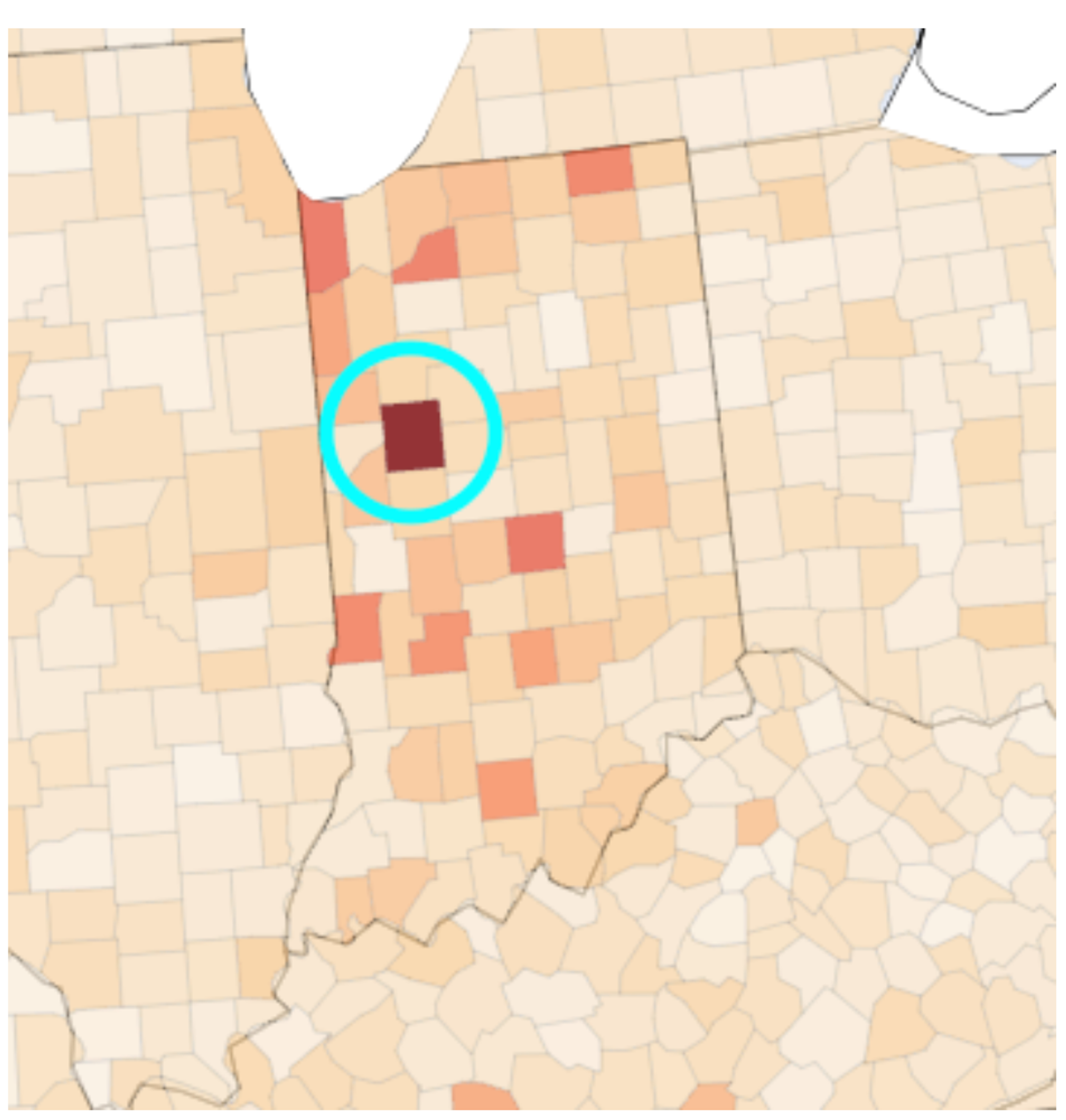

Indiana#indiana

Propel users shopping at the same retail chain in Indiana saw similarly high future liquidation victim rates. 13 stores had victimization rates from 15-54%. 38% of Indiana users liquidated from August 1 - September 7 spent at one of these specific stores beforehand.

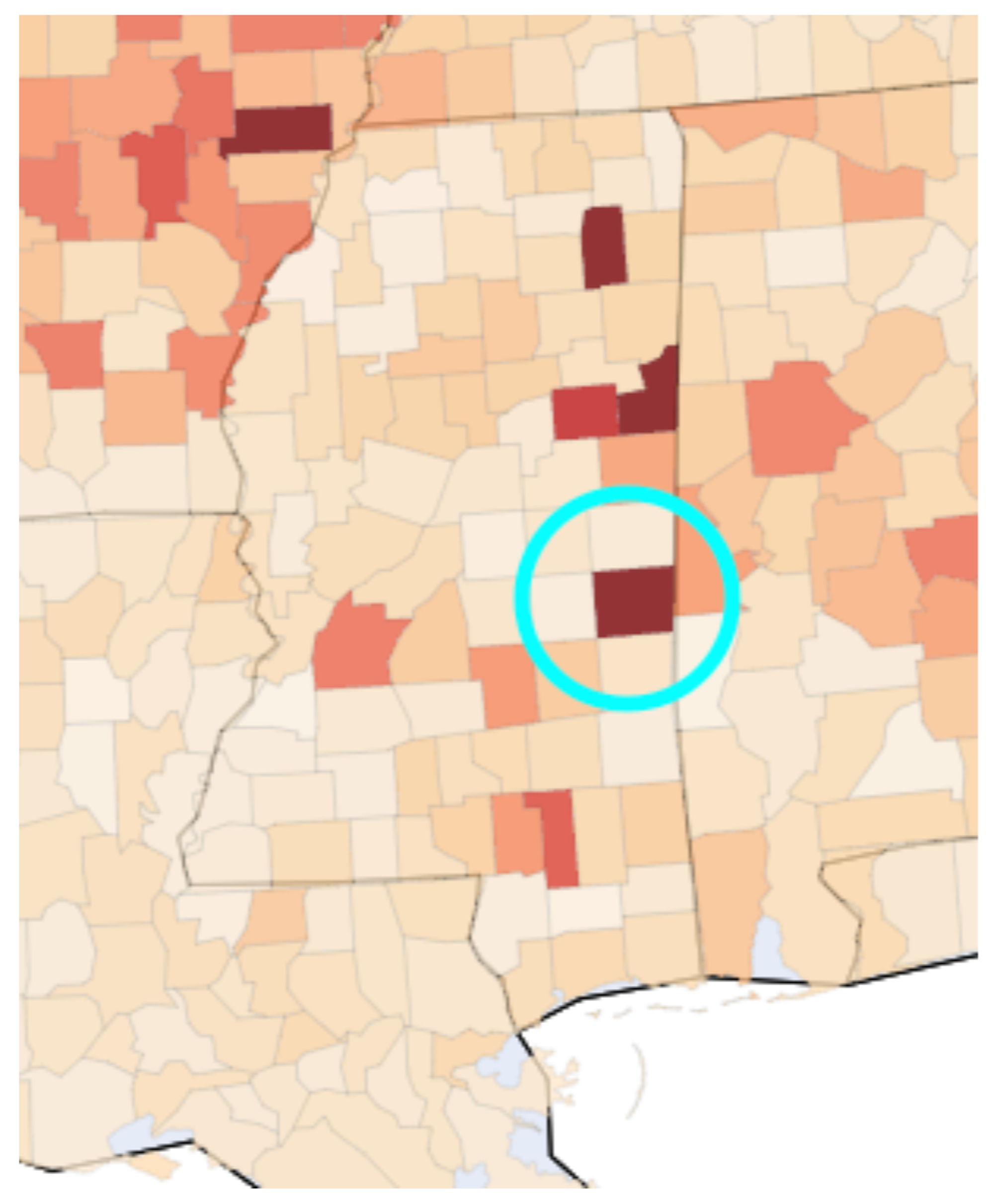

Tippecanoe County, Indiana was hit particularly hard during this time period. 8% of users in this county, circled in blue below, marked a transaction unrecognized between August 1 - September 7.

Alabama#alabama

Alabama sees a similar trend, though a smaller percentage of users shopped at the targeted retailer before being liquidated than in Mississippi or Indiana. 11 stores had future liquidation victim rates of 15-31%, and 24% of users defrauded August 1 - September 7 spent at one of these stores beforehand.

Alabama had high theft rates in June and July that weren’t clearly attributed to skimmers. It is possible that some portion of August theft was a holdover from accounts compromised during this earlier period, while the rest was driven by skimmers.

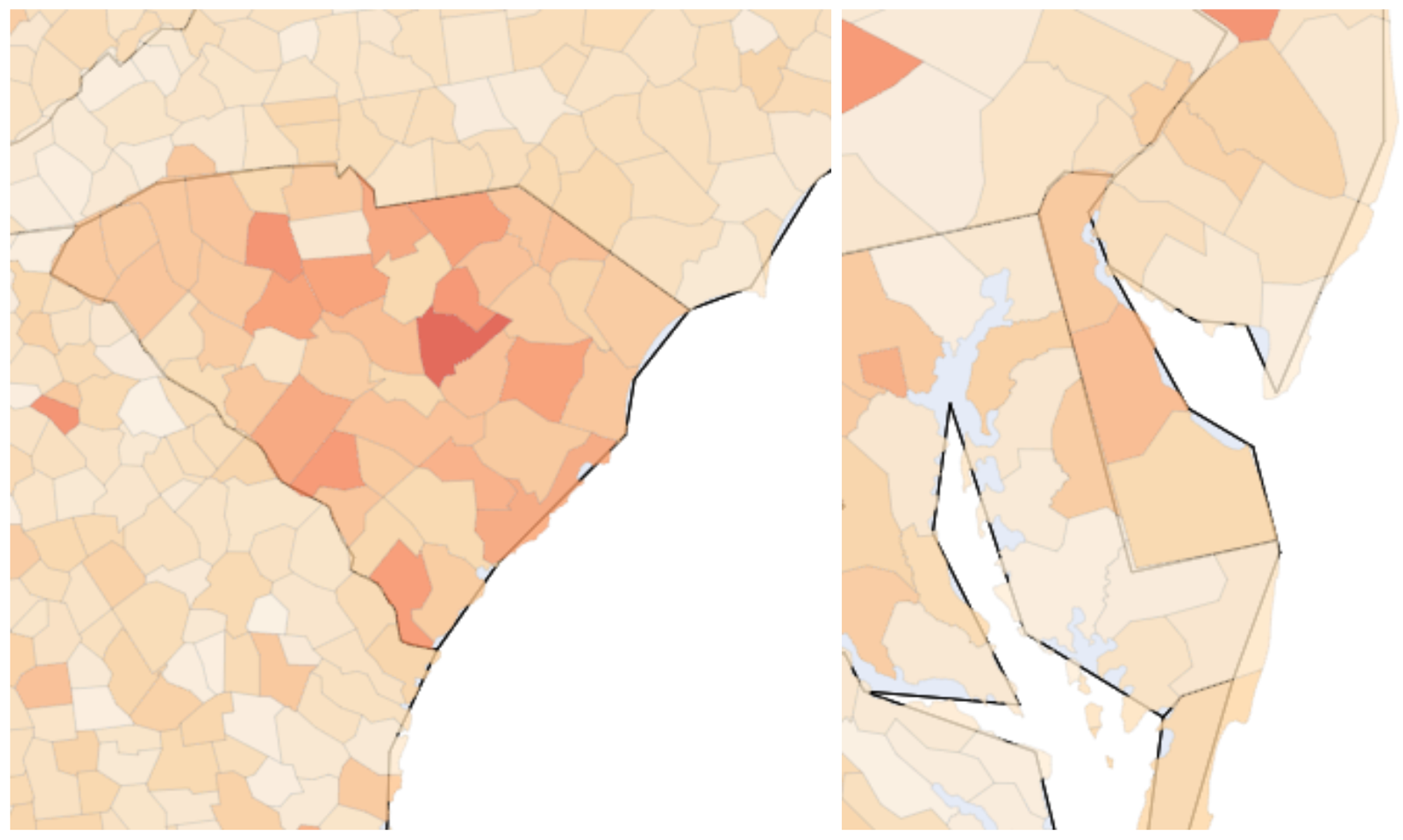

Non-skimming card compromise in South Carolina and Delaware#non-skimming-card-compromise-in-south-carolina-and-delaware

South Carolina and Delaware, both states with relatively high theft levels earlier in the year, saw increases in theft from July to August. It’s unlikely that skimming drove this increase given geographical patterns – unrecognized transactions are spread across these states with clear boundaries at their borders (rather than clustered in one area).

Arkansas theft declining after July peak#arkansas-theft-declining-after-july-peak

In July almost 1 out of 100 Arkansas users marked a transaction unrecognized. The first half of August saw continued high rates of theft in the state, but they returned to normal on August 16. Early September saw much less theft reported than early July and August.

Ongoing support#ongoing-support

Propel is committed to supporting state and federal agencies in protecting SNAP recipients from EBT theft. For questions about our methodology or further analysis, please contact gov@joinpropel.com.