'They're stealing food from my kids': SNAP recipients and the struggle against EBT theft

EBT theft has deeply damaged the lives of the lowest-income Americans. The following insights reveal a system that leaves people in the dark and fails to protect a crucial lifeline.

MAY 22, 2024#may-22-2024

“No one cares since we are the lower class,” Britt, a Propel user from Maryland, wrote in. “No chips on cards, no assistance for years. It’s a shame.”

In recent years, EBT theft has deeply damaged the lives of the lowest-income Americans and inflicted significant financial losses on taxpayers. In California alone, the loss has amounted to at least $181 million, while the federal government has spent at least $61.5 million in replacement benefits in the past year. Britt and other victims of EBT theft have been confronted with dire choices, like between going hungry and forgoing rent.

We surveyed 10,690 EBT customers through Propel ( propel.app) about their awareness of the fast-evolving crime and the challenges they face in protecting themselves. We also reached 1,770 people directly affected by the crime to better understand their experiences and their efforts to seek reimbursement. Here’s what we learned:

- Over half of benefits recipients surveyed have limited to no understanding of scams like skimming and phishing.

- Half of surveyed theft victims don’t know how or where their benefits were stolen.

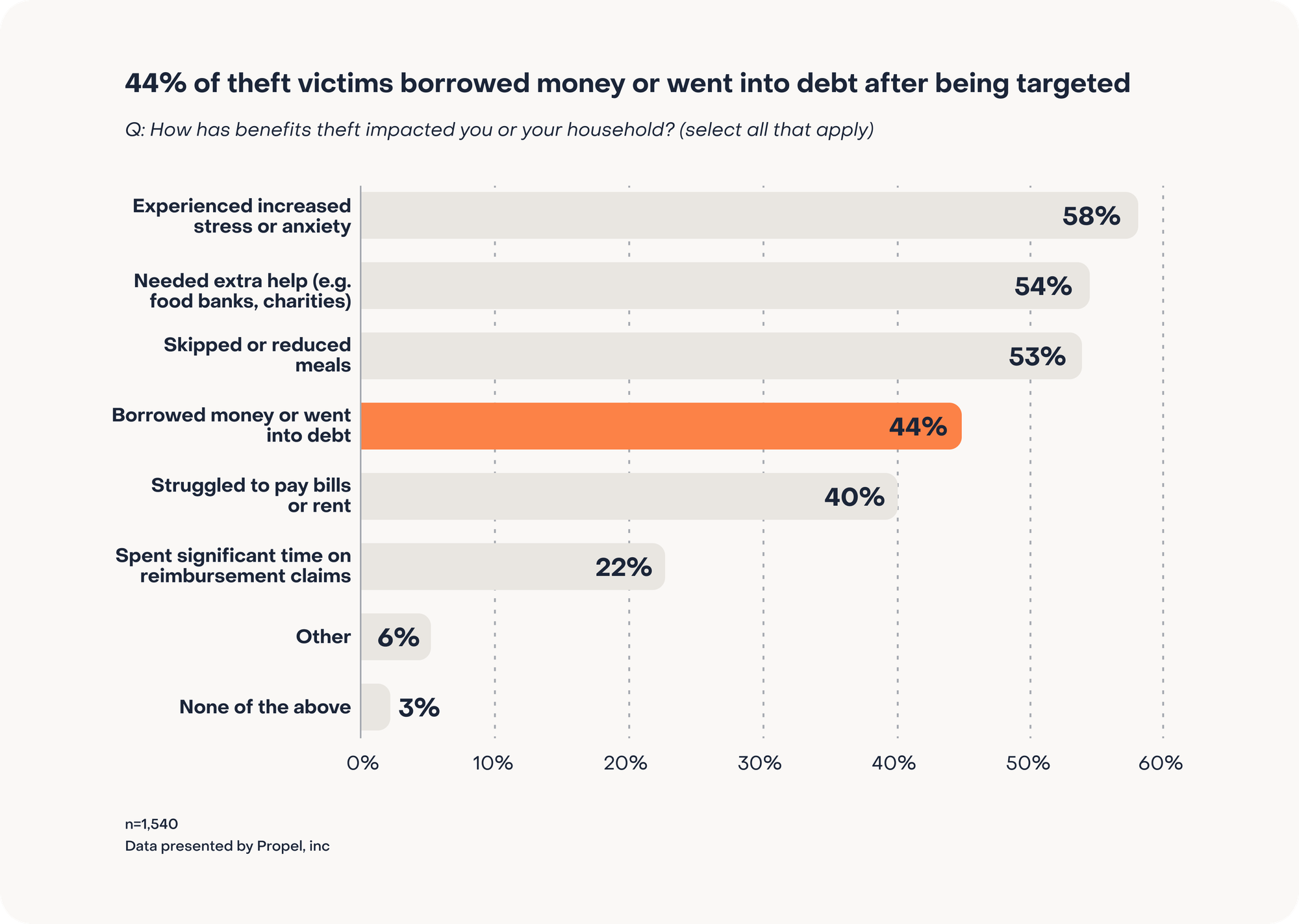

- 53% of victims were forced to skip meals or eat less because of EBT theft and 44% had to borrow money or go into debt.

- 55% of victims either filed unsuccessfully for replacement benefits or did not pursue a reimbursement claim at all.

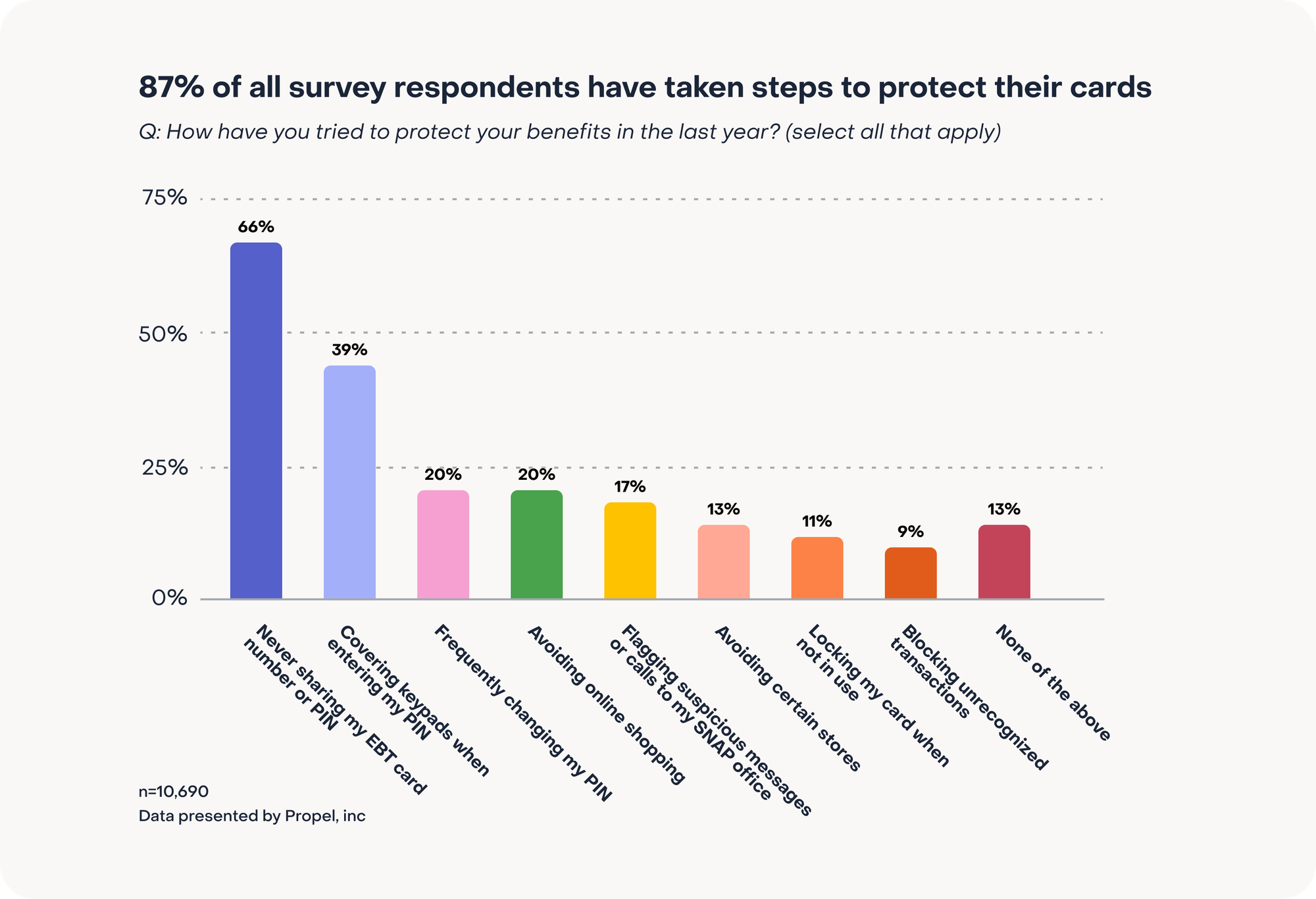

- 87% of all EBT customers surveyed have actively sought to protect their cards.

- 90% of theft victims want additional security features for EBT cards, including chip cards, card-locking, out-of-state transaction blocking, and mobile wallet access.

In December 2022, Congress passed a temporary measure allowing victims of EBT theft to seek limited reimbursement for thefts occurring between October 2022 and September 2024. The same legislation started the process of developing a chip card standard for EBT. As the temporary reimbursement window approaches its end, EBT theft continues to affect American families at an unprecedented rate.

While many stakeholders are working hard to improve EBT security protections, fear and resignation are evident in thousands of survey comments. Like other Propel users we heard from, Michael from Washington felt utterly alone: “I feel totally helpless, totally victimized, and nobody has been helpful in this process whatsoever.”

The following insights reveal a system that leaves people in the dark and fails to protect a crucial lifeline for low-income Americans. Systemic reforms are essential to close the security gap between mainstream financial services and EBT, to ease outsized burdens on vulnerable customers, and uphold the integrity of this essential safety net system.

STATE INSIGHTS#state-insights

We received substantial responses in select states. Dive deeper into the theft-related experiences of EBT beneficiaries in California, New York, Maryland, Michigan, and Washington.

The rise of EBT theft#the-rise-of-ebt-theft

More than 42 million Americans rely on their EBT cards to buy food and essentials through the Supplemental Nutrition Assistance Program (SNAP), Temporary Aid to Needy Families Program (TANF), and other state-run assistance programs. EBT cards work like debit cards and can be used at authorized retailers to buy groceries. Cash benefits can be accessed both at participating stores and at approved ATMs. Retailers also increasingly accept EBT for online purchases and grocery delivery.

EBT theft occurs when scammers steal sensitive account information through tactics like card skimming and phishing, and drain funds that low-income families were counting on to feed their children or pay rent. Skimming involves using concealed devices on card readers at stores and ATMs to copy EBT card information. Phishing scams use fraudulent texts, calls, or emails to gather account details and other personal information. These types of crimes have been on the rise since at least 2022.

While the rest of the payments industry has instituted advanced security features such as embedded microchips and contactless payment, EBT card information remains stored on magnetic stripes—technology that dates back to the 1960s—which are easily copied. EBT cards are also excluded from federal regulations that shield credit and debit card holders from fraud.

In response to the surge in reported cases, Congress passed the Consolidated Appropriations Act, 2023, requiring states to replace SNAP benefits stolen between October 1, 2022 and September 30, 2024. States were tasked with standing up reimbursement processes on short notice, and the majority of state reimbursement processes did not become available until July and August 2023. Arkansas’s replacement process for stolen SNAP benefits, the final state plan to be approved, won’t be implemented until June 2024, just four months before the federal mandate to compensate victims expires.

People lack critical information about EBT theft#people-lack-critical-information-about-ebt-theft

To gauge the existing levels of awareness around EBT theft among the five million households using Propel each month, we conducted an optional 4-minute, in-app, multiple choice and open-response survey in English and Spanish from April 1 through April 14, 2024. Our messaging focused primarily on recruiting users who have experienced EBT theft, allowing us to gather data on the repercussions they have faced since being targeted.

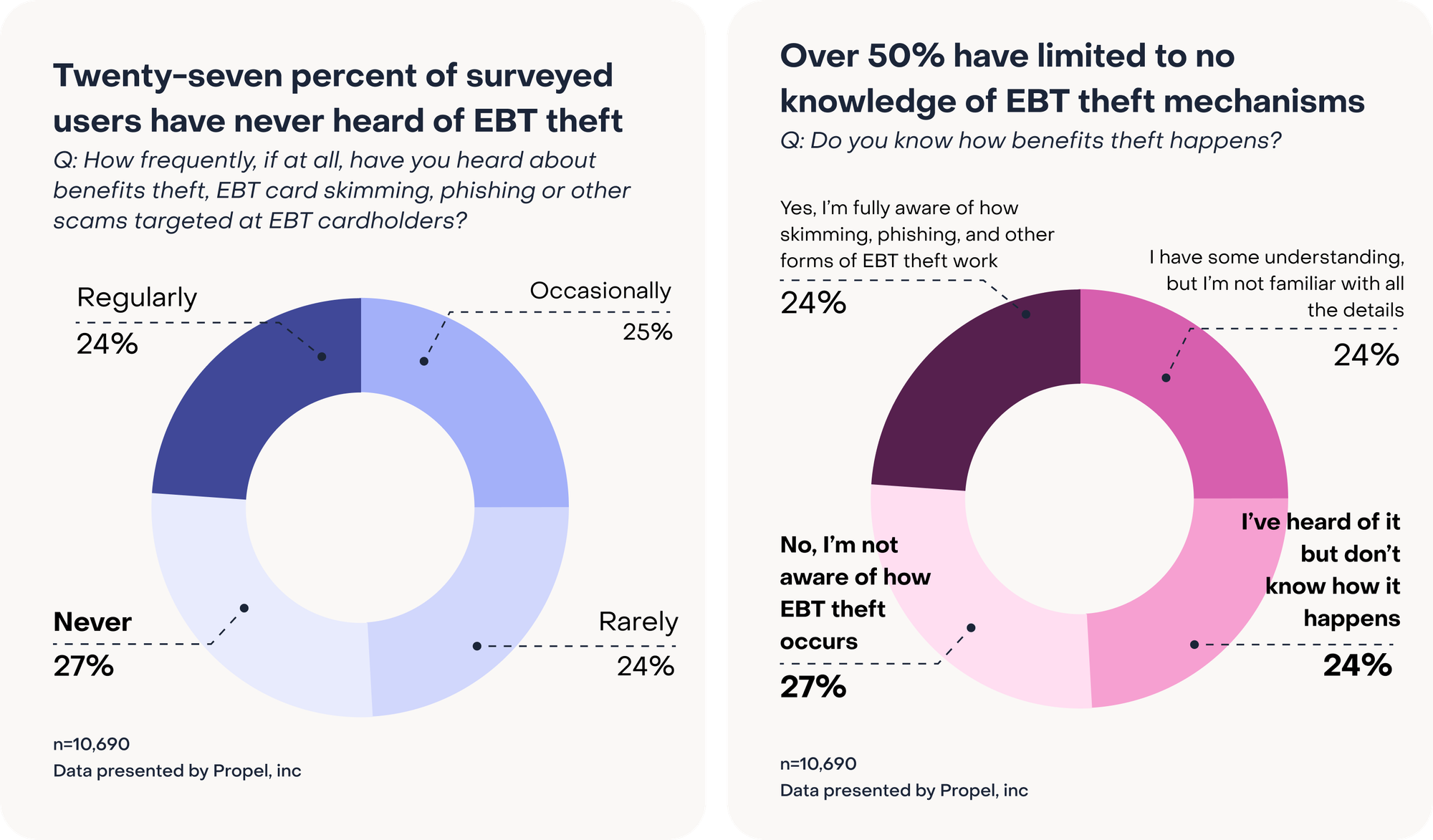

Despite 86 percent of our users being highly "online" and accessing the internet several times or more each day, a surprising 27 percent of users surveyed had never heard about EBT theft and scams targeting EBT cardholders before taking the survey.

Athena, a surveyed Propel user from Washington, said she “didn’t really believe [in EBT theft]” because it had never happened to anyone she knew.

“I didn’t know that [criminals] can scan our cards or steal from them like that. I thought it was not possible with our EBT cards. Like they were protected somehow.”

Sixty percent of respondents are “very” or “extremely” concerned about their benefits being stolen. However, over 51 percent of all surveyed benefits recipients have limited to no understanding of the mechanisms involved in skimming and phishing scams. This knowledge gap persists even among theft victims, with 41 percent remaining largely unaware of how these criminal tactics work.

Half of the surveyed theft victims couldn’t trace these crimes back to their original sources, and only 21 percent could determine that their EBT cards were skimmed at a store. Respondents had more clarity over whether their accounts were drained in- or out-of-state: 51 percent identified their stolen benefits were spent or withdrawn in-state, and 35 percent reported unauthorized out-of-state transactions. Still, 14 percent of victims have no idea where their EBT funds were used.

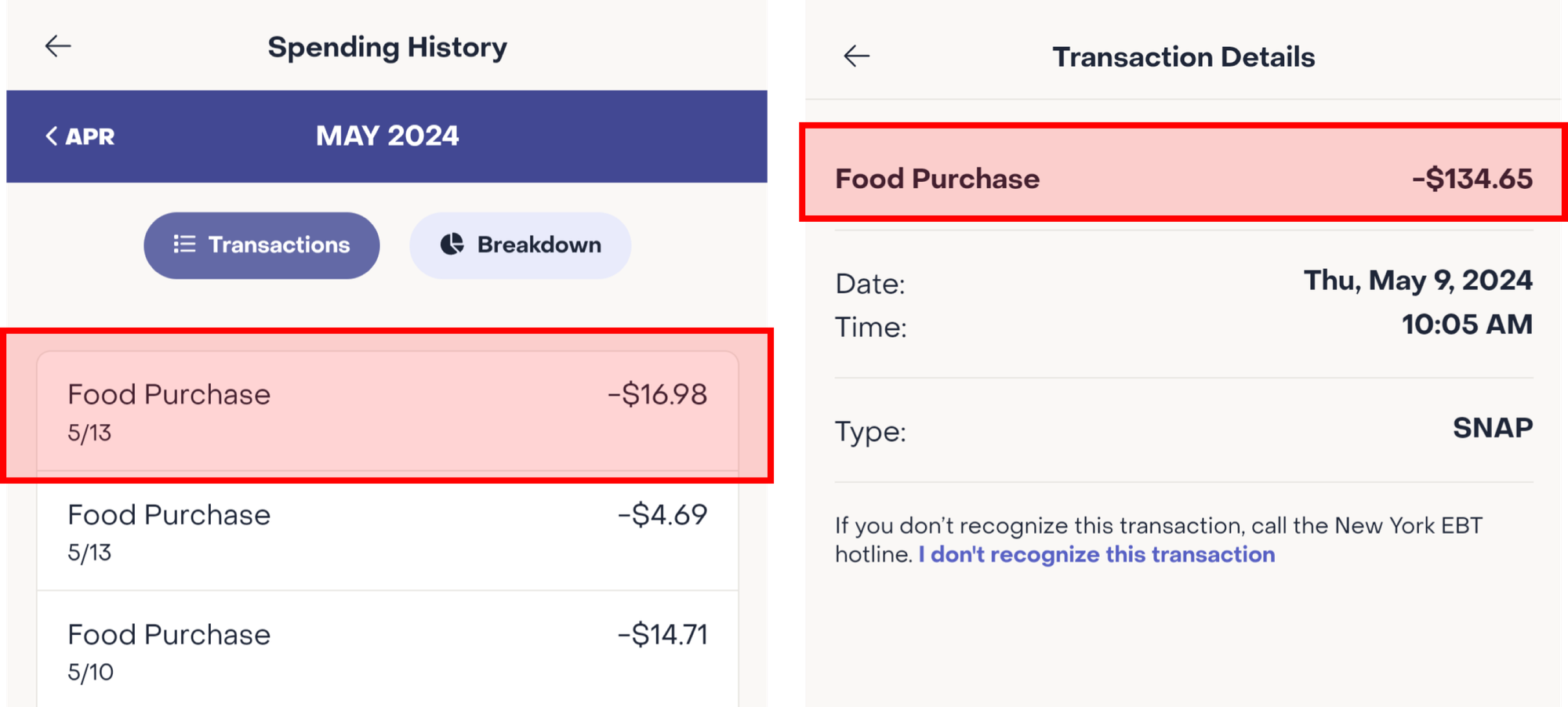

Consumer access to transaction history varies by state. Nearly half of state-sponsored web platforms provide the time and date of transactions but withhold location details. Instead of a store name and address with each transaction, users in these states will typically see only “food purchase.” Consequently, they cannot determine if a transaction occurred locally or across the country, posing a major obstacle to identifying and reporting theft for reimbursement claims.

EBT theft intensifies ongoing food and financial insecurity#ebt-theft-intensifies-ongoing-food-and-financial-insecurity

Among the 1,770 surveyed individuals impacted by EBT theft, 81 percent reported theft of SNAP benefits, experiencing an average loss of $925 altogether. A smaller share of respondents lost cash benefits, with a higher average loss of $1,482. Around 12 percent had both SNAP and cash benefits stolen.

EBT theft has a significant impact on the financial and physical health of SNAP households. For families already grappling with widespread food insecurity, EBT theft further compounds existing hardships. Forty-four percent of victims borrowed money or went into debt as a result of EBT theft. Forty percent struggled to pay for essential expenses like rent and utilities after their benefits were stolen. Fifty-three percent of theft victims skipped meals or reduced their portions, and 54 percent relied on food banks or other charitable organizations for food when they lost their benefits. Nearly 60 percent reported increased stress or anxiety. These hardships underscore the acute vulnerability of households reliant on EBT accounts for daily needs, and the urgency of making EBT technology more secure.

Most theft victims either failed to secure reimbursement or did not file a claim at all#most-theft-victims-either-failed-to-secure-reimbursement-or-did-not-file-a-claim-at-all

The USDA’s Stolen Benefits Dashboard reports data on reimbursement claims from the states. In Q1 2024, 48 states approved 66,035 claims for reimbursement and reported over 176,000 fraudulent transactions. The federal government paid out more than $31 million in replacement benefits that quarter. However, survey evidence suggests that the dashboard data represents only a fraction of the actual scale of EBT theft. Over half of theft victims surveyed—55 percent—reported that their claims were denied (19%) or they did not file a claim at all (36%).

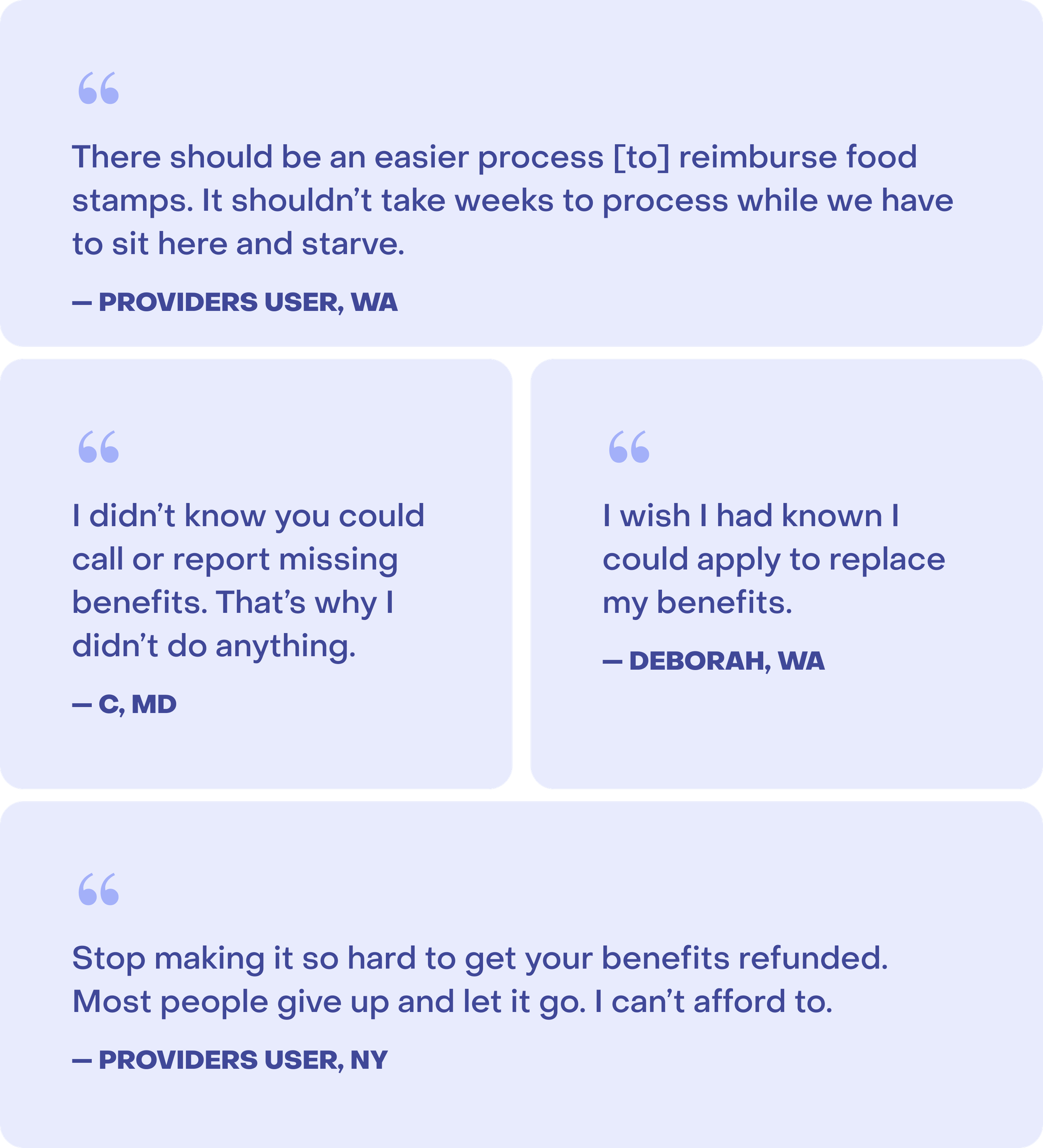

In a follow-up poll of a smaller sample of respondents who did not file a claim, the most common reasons were not knowing they could (50%) and believing it wouldn’t be worth the effort (24%).

“I didn’t know I could get those benefits replaced,” wrote Chino, a Propel user from California. “It’s very frustrating and has such an impact on [my] kids. The thief didn’t steal from me, they stole from the children.”

The burden for reporting stolen benefits falls squarely on victims, who must meticulously document unauthorized transactions and substantiate fraudulent activity. In the first quarter of 2024, the USDA’s Dashboard reported that 16,608 (20%) of reimbursement claims were denied. Of these, 14,327 (81%) were deemed “invalid,” 3,039 were “untimely,” and over 300 (2%) were rejected because claimants had reached the USDA’s two-time replacement limit per EBT customer.

Over 40 percent of theft victims reported the process of filing for reimbursement to be “somewhat” or “very” difficult, and 22 percent reported spending a “significant” amount of time on filing their claim.

“It’s too hard to get your stuff replaced,” wrote Lea, a Propel user from Oregon. “[It’s] just as much stress as losing the assistance.”

EBT customers want to protect their benefits but need systemic protection#ebt-customers-want-to-protect-their-benefits-but-need-systemic-protection

Nearly 90 percent of all EBT customers surveyed have taken active steps to protect their cards, but the tools currently available to them are inadequate. Government websites offer tips and resources that are better at identifying theft than preventing it. Without real security improvements like chip cards, EBT cardholders are stuck with the burden of constantly monitoring for fraud and changing their PINs every month.

Among our survey respondents, 21 percent frequently change their PINs to prevent unauthorized access, and 17 percent have reported suspicious communications like texts, calls, or social media posts to their local SNAP offices. Twenty percent avoid online shopping altogether due to security concerns. Nine percent have blocked unrecognized out-of-state or online transactions, and 11 percent lock their cards when not in use—both are new EBT account features that aren’t available in all states and don't protect against having card information skimmed.

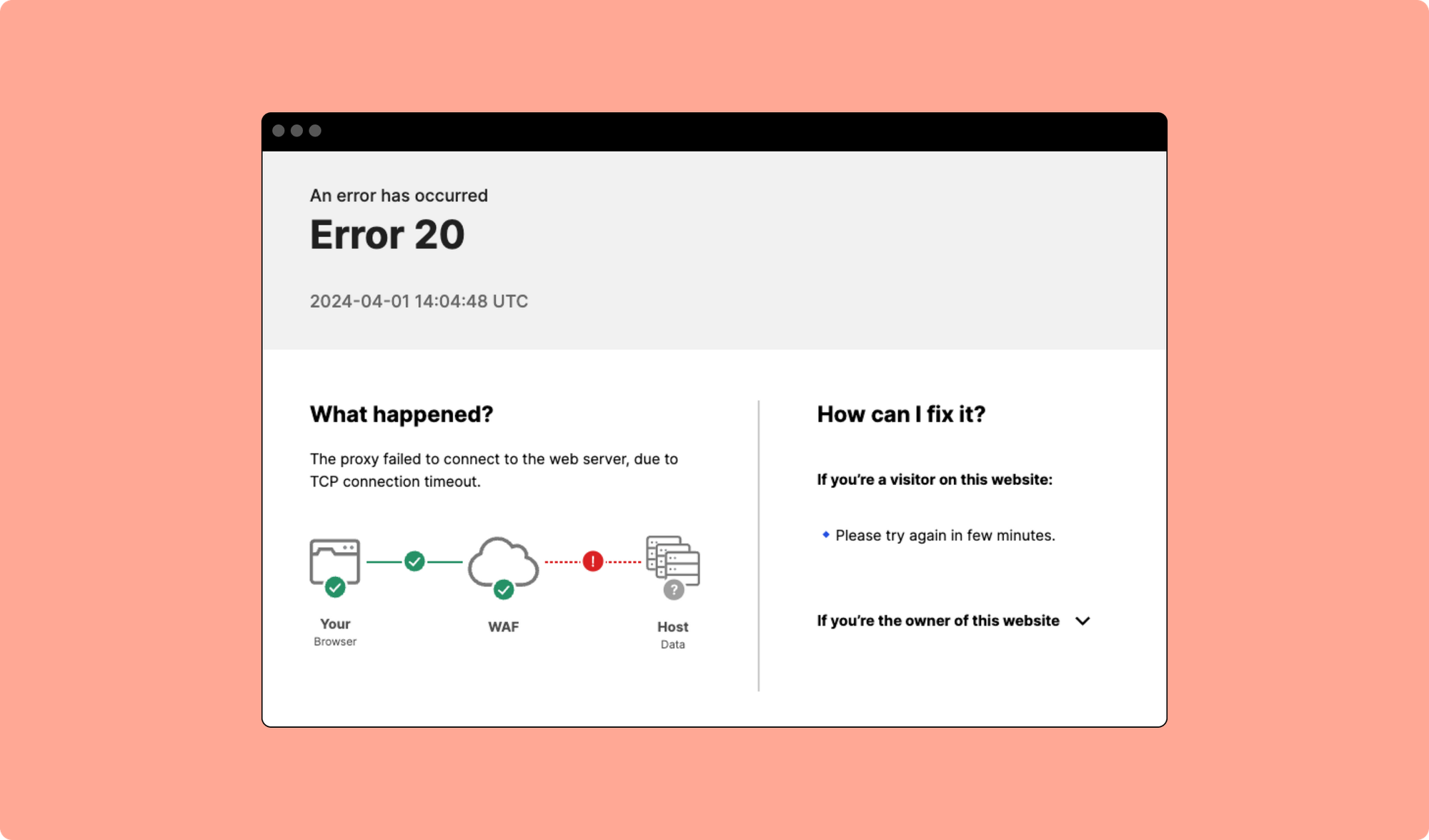

Card-locking also faces persistent data access challenges in the EBT system. According to 2024 Propel data, EBT clients nationwide often cannot access their account information (such as balance and transaction history) via the state-contracted online portal. On average, 1 in 20 attempts to check balances online fails nationwide. In some states, the online portal fails almost 1 in 10 times, with outages sometimes lasting for days. Additionally, not all states offering card-locking services have enabled them via call center. In those places, consumers risk being stranded at grocery stores, unable to reach a customer service hotline or unlock their cards due to recurring EBT data access instability.

EBT customers are doing everything they can, but they recognize it’s simply not enough. Ninety percent of surveyed victims want additional security features for EBT cards, including chip cards, contactless payment, card-locking, and out-of-state transaction blocking.

“I definitely think putting more security features as options for card holders is a plus,” wrote Mel from Washington. “The option to lock or freeze your card unless you’re using it is a great feature. I have it in my debit card and use it regularly.”

Policymakers must take aggressive action to reduce theft and improve consumer protections#policymakers-must-take-aggressive-action-to-reduce-theft-and-improve-consumer-protections

EBT theft causes serious financial harm and hardship for public benefits recipients. The immense psychological stress is unimaginable for the average bank customer, who gets quick notifications about suspicious transactions, can report stolen cards and dispute charges online, and is often guaranteed reimbursement. This disparity highlights the systemic, second-class treatment of low-income households.

“The state definitely needs to upgrade their systems to make it very difficult, if not impossible, for theft to occur,” wrote Nikki from Texas. “And [they] definitely need a better system of replacing benefits...the last person who should be so greatly affected are the people depending on those benefits to feed themselves and their families.”

States, caseworkers, taxpayers, and the US economy are also victims of these crimes. Every dollar stolen means another retailer losing sales, another distressed and overworked caseworker, and another cost to taxpayers.

State and federal policymakers have a clear path forward:

Extend the reimbursement authority and simplify claims processes. Congress should extend and amend the existing reimbursement authority. As EBT theft continues to rage, and with just two states in sight of adopting systemic protections via chip cards, leaving low-income households vulnerable to criminal predators is not an acceptable option. Furthermore, one-third of surveyed theft victims have been targeted multiple times. Congress should remove the two-incidence cap and reimburse the full amount of each theft.

Consumers remain largely unaware of the availability of the reimbursement process, and too often deterred by administrative complexity. States and the USDA should take steps to raise awareness about reimbursement and streamline claims processes to ensure victimized households can access support seamlessly.

Close the security gap between mainstream financial services and EBT. Public benefits are taxpayer investments in the well-being of low-income households, who are especially vulnerable to organized crime rings due to no fault of their own. To protect these investments and prevent the financial and emotional damage documented in our survey, Congress should act now to close the gap between security standards in EBT and mainstream financial services.

Broad authority was granted to the USDA in the Consolidated Appropriations Act, 2023 to create “ongoing” guidance that requires state action to shore up EBT card security, but Congress did not provide a date certain by which that guidance must be promulgated, nor has it provided additional funds necessary to hasten this transition. Congress should require the rapid adoption of chip cards and card-locking technology, both electronically and telephonically, and deliver federal funding to ensure consumers and taxpayer dollars are protected as quickly as possible.

The EBT system needs mechanisms to keep its security on par with industry standards, rather than non-specific, “ongoing” guidance, Congress should mandate a specific term for periodic review and updates of EBT card security measures.

Congress should also recognize the importance of providing people who rely on EBT with reliable electronic access to their balance and transaction data. The limited data and frequent portal outages experienced by consumers who use EBT is a barrier to their financial well-being. The Consumer Financial Protection Bureau (CFPB) is expected to finalize a rule later this year providing consumers with a legal right to access and share access to their financial account data electronically. The CFPB is considering whether to include EBT accounts within the scope of this rule, Congress should unambiguously ensure EBT accountholders have the same basic rights and consumer protections as others.

Hear from the Propel community:#hear-from-the-propel-community

We asked our users to share their perspectives on EBT theft. In the table below you can sort through real quotes from more than 110 real Propel users and the messages they felt were most important to share.