Unfortunately, many people who are eligible don’t apply for SNAP (also called food stamps), because they think their savings or other assets, like their house or their car, disqualify them from getting help.

In reality, most states only use income and no longer use an asset limit when deciding whether people qualify for SNAP. Here’s how SNAP asset limits work and which states still have them.

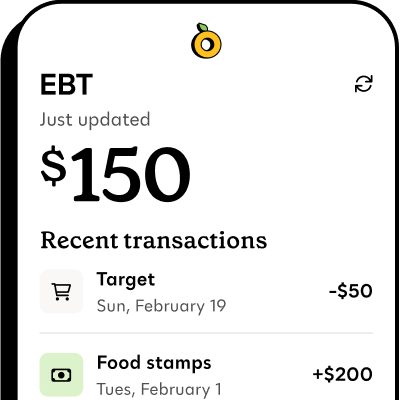

Propel is the #1-rated EBT balance checking app

What are SNAP asset limits?#what-are-snap-asset-limits

An asset limit (sometimes called a resource limit) is a rule that sets a maximum amount of assets a household can have to still qualify for SNAP benefits.

If your state has an asset limit, that means the state will count the value of anything you own that counts as a “liquid asset.”

If you have more than your state’s SNAP set asset limit, you will be ineligible for SNAP or need to spend down the funds in order to become eligible.

Liquid assets are assets that can be easily used to buy food. Examples of liquid assets that count for SNAP eligibility in some states include:

- Money in checking or savings accounts

- Cash or other money available that you could use to buy food

“Non-liquid” assets are not considered for SNAP eligibility because they can’t be easily used to buy food. These include:

- Retirement accounts like a 40(k) or IRA

- Vehicles, in most cases

- Your home or personal belongings

The 2026 federal asset limits are the same as they were in 2025. The federal asset limit for households is $3,000 and the federal asset limit for households where at least one person is age 60 or older, or is disabled, is $4,500.

A few states set their own higher asset limits than the federal ones.

What states have asset limits for SNAP?#what-states-have-asset-limits-for-snap

Many states no longer have asset limits in order to qualify for SNAP. Getting rid of asset limits helps reduce paperwork burden for applicants and state staff.

It can also help eliminate the need for families to spend down their savings and make themselves financially vulnerable before assistance kicks in.

But some states do have asset limits in 2026, including:

- Alaska

- Arkansas

- Idaho

- Indiana

- Kansas

- Mississippi

- Missouri

- Nebraska

- South Dakota

- Tennessee

- Texas

- Utah

- Wyoming

If you live in any of these states and have savings above these limits, it's much more likely you will be found ineligible for SNAP.

Your state will expect you to use your assets to buy groceries. You can reapply for SNAP once you “spend down” your savings and reach the asset limit.

What about households with seniors or people with disabilities?#what-about-households-with-seniors-or-people-with-disabilities

There’s another situation where asset limits can impact SNAP eligibility. If your household includes a senior or disabled member and your income is above the standard SNAP income limit, you may still qualify under special rules, but with an asset limit applied.

This is a less common and more complex situation. If you think this might apply to you, consider:

- Asking your caseworker for help

- Contacting a local SNAP office, food bank or legal aid office