Can you use coupons with EBT?

Yes, you can use coupons with your EBT card.

If you qualify for food stamps ( also called SNAP) or cash assistance, like TANF, you’ll get an EBT card in the mail. With this card, you can buy food at grocery stores, farmers' markets, and online retailers. You can also get discounts on transportation, utilities, and more.

Using coupons with your EBT card can save you money by reducing the price of a SNAP-eligible item. But coupon policies vary by retailer and by where you live.

Learn how to use coupons with your food stamps.

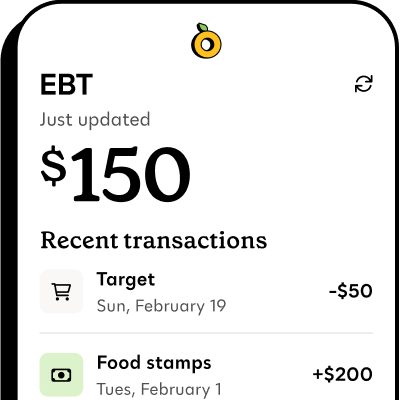

Propel is the #1-rated EBT balance checking app

How do I use coupons with my food stamps?#how-do-i-use-coupons-with-my-food-stamps

Most stores that take SNAP will treat SNAP payments like any other form of payment and will apply coupons in the same way. That means when you present a coupon for a SNAP-eligible item at the register, the price will be reduced, and your SNAP benefits will be used to cover the rest. This lowers the overall amount taken from your EBT card, saving you money.

Both paper and digital coupons can be used with SNAP as long as you meet store or manufacturer requirements. For example, some stores may limit the number of coupons you can use per item, or a minimum purchase amount might need to be met before a coupon can be used.

Sales tax and coupons#sales-tax-and-coupons

Another thing to keep in mind is sales tax. Federal law prohibits sales tax on any food bought entirely with SNAP, so your total stays at the sticker price.

However, if you live in a state with a grocery tax, and you want to buy an item using SNAP and a coupon, you will need to pay the sales tax on your coupon-discounted food item using another form of payment, like cash or debit.

As of 2026, 8 states still have a grocery tax:

- Alabama

- Hawaii

- Idaho

- Mississippi

- Missouri

- South Dakota

- Tennessee

- Utah

Alabama

2% tax rate

Alabama

2% tax rate

Alaska

No tax on groceries

Alaska

No tax on groceries

Arizona

No tax on groceries

Arizona

No tax on groceries

Arkansas

No tax on groceries

Arkansas

No tax on groceries

California

No tax on groceries

California

No tax on groceries

Colorado

No tax on groceries

Colorado

No tax on groceries

Connecticut

No tax on groceries

Connecticut

No tax on groceries

Delaware

No tax on groceries

Delaware

No tax on groceries

Florida

No tax on groceries

Florida

No tax on groceries

Georgia

No tax on groceries

Georgia

No tax on groceries

Guam

No tax on groceries

Guam

No tax on groceries

Hawaii

4% tax rate

Hawaii

4% tax rate

Idaho

6% tax rate

Idaho

6% tax rate

Illinois

No tax on groceries

Illinois

No tax on groceries

Indiana

No tax on groceries

Indiana

No tax on groceries

Iowa

No tax on groceries

Iowa

No tax on groceries

Kansas

No tax on groceries

Kansas

No tax on groceries

Kentucky

No tax on groceries

Kentucky

No tax on groceries

Louisiana

No tax on groceries

Louisiana

No tax on groceries

Maine

No tax on groceries

Maine

No tax on groceries

Maryland

No tax on groceries

Maryland

No tax on groceries

Massachusetts

No tax on groceries

Massachusetts

No tax on groceries

Michigan

No tax on groceries

Michigan

No tax on groceries

Minnesota

No tax on groceries

Minnesota

No tax on groceries

Mississippi

5% tax rate

Mississippi

5% tax rate

Missouri

1.225% tax rate

Missouri

1.225% tax rate

Montana

No tax on groceries

Montana

No tax on groceries

Nebraska

No tax on groceries

Nebraska

No tax on groceries

Nevada

No tax on groceries

Nevada

No tax on groceries

New Hampshire

No tax on groceries

New Hampshire

No tax on groceries

New Jersey

No tax on groceries

New Jersey

No tax on groceries

New Mexico

No tax on groceries

New Mexico

No tax on groceries

New York

No tax on groceries

New York

No tax on groceries

North Carolina

No tax on groceries

North Carolina

No tax on groceries

North Dakota

No tax on groceries

North Dakota

No tax on groceries

Ohio

No tax on groceries

Ohio

No tax on groceries

Oklahoma

No tax on groceries

Oklahoma

No tax on groceries

Oregon

No tax on groceries

Oregon

No tax on groceries

Pennsylvania

No tax on groceries

Pennsylvania

No tax on groceries

Puerto Rico

No tax on groceries

Puerto Rico

No tax on groceries

Rhode Island

No tax on groceries

Rhode Island

No tax on groceries

South Carolina

No tax on groceries

South Carolina

No tax on groceries

South Dakota

4.2% tax rate

South Dakota

4.2% tax rate

Tennessee

4% tax rate

Tennessee

4% tax rate

Texas

No tax on groceries

Texas

No tax on groceries

Utah

3% tax rate

Utah

3% tax rate

Vermont

No tax on groceries

Vermont

No tax on groceries

Virginia

No tax on groceries

Virginia

No tax on groceries

Washington

No tax on groceries

Washington

No tax on groceries

Washington D.C.

No tax on groceries

Washington D.C.

No tax on groceries

West Virginia

No tax on groceries

West Virginia

No tax on groceries

Wisconsin

No tax on groceries

Wisconsin

No tax on groceries

Wyoming

No tax on groceries

Wyoming

No tax on groceries

Note that local taxes, managed by cities or counties, may apply even in states that don’t have a statewide grocery tax.

To see if your specific city or county taxes groceries, check a recent receipt for a “T” (taxable) next to basic items like bread or milk. If you see one, local taxes apply even in states without a broad grocery tax.

Can I use SNAP with coupons on non-food items?#can-i-use-snap-with-coupons-on-non-food-items

No, food stamps can only be used to buy food. SNAP benefits cannot be used for non-eligible items, even if you have a coupon for them.

Non-food items and hot, ready-to-eat foods are all ineligible. For example, if you wanted to buy a rotisserie chicken or soup from a deli, you’d need to use another form of payment, like cash, debit, credit, or TANF. You can't use your EBT card to pay for that item.

Here is a summary of what you can not purchase with SNAP:

- Alcohol & tobacco

- Hot, ready‑to‑eat foods

- Vitamins, supplements & medicine

- Pet food

- Cleaning & household supplies

- Personal care & hygiene items

- Diapers & wipes

- Live animals (with limited exceptions)

In addition, some states have SNAP bans on snacks, energy drinks, soda, and other items. Check to see if your state has a ban.

What additional discounts can I get with SNAP?#what-additional-discounts-can-i-get-with-snap

Using grocery coupons is just one of several ways you can maximize your SNAP benefits.

Beyond the aisles of the supermarket, you can unlock more savings using your EBT card. Double your buying power at local farmers' markets through bonuses and produce matching, or enjoy discounted memberships and free delivery at retailers like Amazon and Walmart.

You can even use your EBT card to get discounted internet and low-cost admission to hundreds of museums and zoos.

Use the Propel app to find exclusive discounts and coupons available to you.