How to apply for unemployment

Table of contents

If you recently lost your job or had your hours sharply reduced, you may be eligible for unemployment benefits. Unemployment benefits typically come as a weekly cash deposit to help you get by while you’re out of work.

Eligibility rules for unemployment are different in each state, but fall within the same general framework. Here’s how to apply for unemployment in nine basic steps.

Balance your grocery budget and get access to deals with Propel

1. Confirm your eligibility#1-confirm-your-eligibility

Before going through the application process, see if you fit the Department of Labor’s (DOL) criteria for unemployment benefits.

You may qualify for unemployment if:

- You’re unemployed by no fault of your own, meaning you are no longer at your last job due to a lack of available work

- Your fit your state’s requirements for either wages earned or hours worked

- You meet any additional state-specific guidelines

2. Find your state’s unemployment application portal#2-find-your-states-unemployment-application-portal

To receive unemployment, you have to file in the state where you worked, which might not necessarily be the same state you live in.

Search for your state’s workforce or Department of Labor page to find the unemployment application portal or phone number to contact. Most states allow you to file online claims, but some also take in-person or phone unemployment claims.

3. Gather any required documents#3-gather-any-required-documents

Before you fill out the online unemployment application or visit your state office in person to file an unemployment claim, make sure to gather this information, which you may be asked to provide in your application:

- Social Security Number

- Driver’s license or valid ID

- Reliable mailing address, phone number, or email

- Work history from the last 12 to 18 months, including employer names, addresses, phone numbers, and reason for leaving

- Recent pay stubs or W-2s for proof of income

- Your bank account and routing number (if you want employment benefits paid out through direct deposit)

If you have more specific questions about what your state might require, try to find a checklist on your state's site..

4. File your unemployment claim#4-file-your-unemployment-claim

With documents at the ready, it’s time to file your unemployment claim. When you file, you’ll share information about your work history, including why you’re currently unemployed.

Expect your state to reach out to your recent employer (or employers) to verify this information.

Once you send in your unemployment claim, your state will determine your financial eligibility based on your past wages. If you qualify, you’ll receive a notice explaining your:

- Weekly benefit amount: how much you’ll receive in unemployment each week

- Maximum benefit: how long you’ll be able to get unemployment

- Job-search conditions: how you’ll be required to confirm you’re actively looking for work

Even if you’ve been approved for unemployment, some states have a non-payable waiting week; the first week you’re eligible for unemployment, but not paid.

That means you’ll get unemployment the second week after certification. Check your state’s rules to confirm when you’ll receive your first payment.

5. Certify your weekly unemployment benefits#5-certify-your-weekly-unemployment-benefits

To continue receiving unemployment benefits, most states will require you to submit a weekly or biweekly certification that you’re:

- Still unemployed

- Available and able to work

- Actively looking for work

You’ll probably submit these certifications through an app or website, but in some states, you’ll do so through a regularly scheduled call. If you don’t submit certifications, the state could withhold your unemployment benefits.

Register for reemployment services (varies by state)#register-for-reemployment-services-varies-by-state

In addition to certifying your work status, some states require people getting unemployment to sign-up with a state job service (like CalJOBS in California).

These are online resources to help people find work, and can include job boards, education programs, and other tools.

If you are temporarily disabled or a caregiver, you may be exempt from enrolling in reemployment services, depending on your state.

6. Respond to requests promptly#6-respond-to-requests-promptly

Make sure to keep an eye on mail, email, or phone calls coming from your state unemployment office.

They may request more documents or need additional information if a past employer contests your unemployment claim. Follow up with these requests quickly, or you could lose your benefits.

If an old employer fights your unemployment claim, you’ll have a chance to appeal. Appeals processes vary by state.

8. Protect yourself from fraud#8-protect-yourself-from-fraud

Make sure you’re only sharing information with the official state office. Scams can sometimes follow major layoffs. If a request for information looks suspicious, reach out to your state office right away.

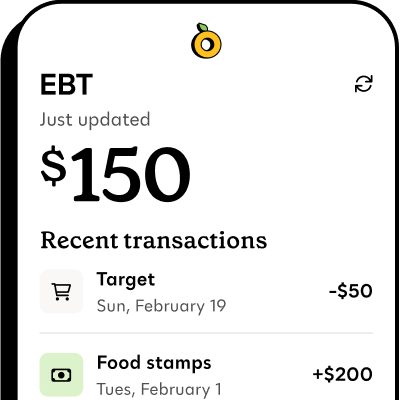

Propel is the #1-rated EBT balance checking app

9. Apply for other benefits programs#9-apply-for-other-benefits-programs

A sudden loss of income from losing a job can make a dramatic impact on your finances. Applying for unemployment benefits is a great start, but you may also be eligible for other assistance programs that can make the job search and the loss of income easier.

Some cities offer free or discounted bus passes for job seekers or low-income riders.

If your loss of income could lead to housing instability, emergency housing assistance in your area may offer temporary housing, rental assistance, and other resources.

And, if your financial hardship makes buying basic needs like groceries a challenge, applying for food stamps could help you save on food costs.