Return to Propel's EBT Theft Hub

Summary

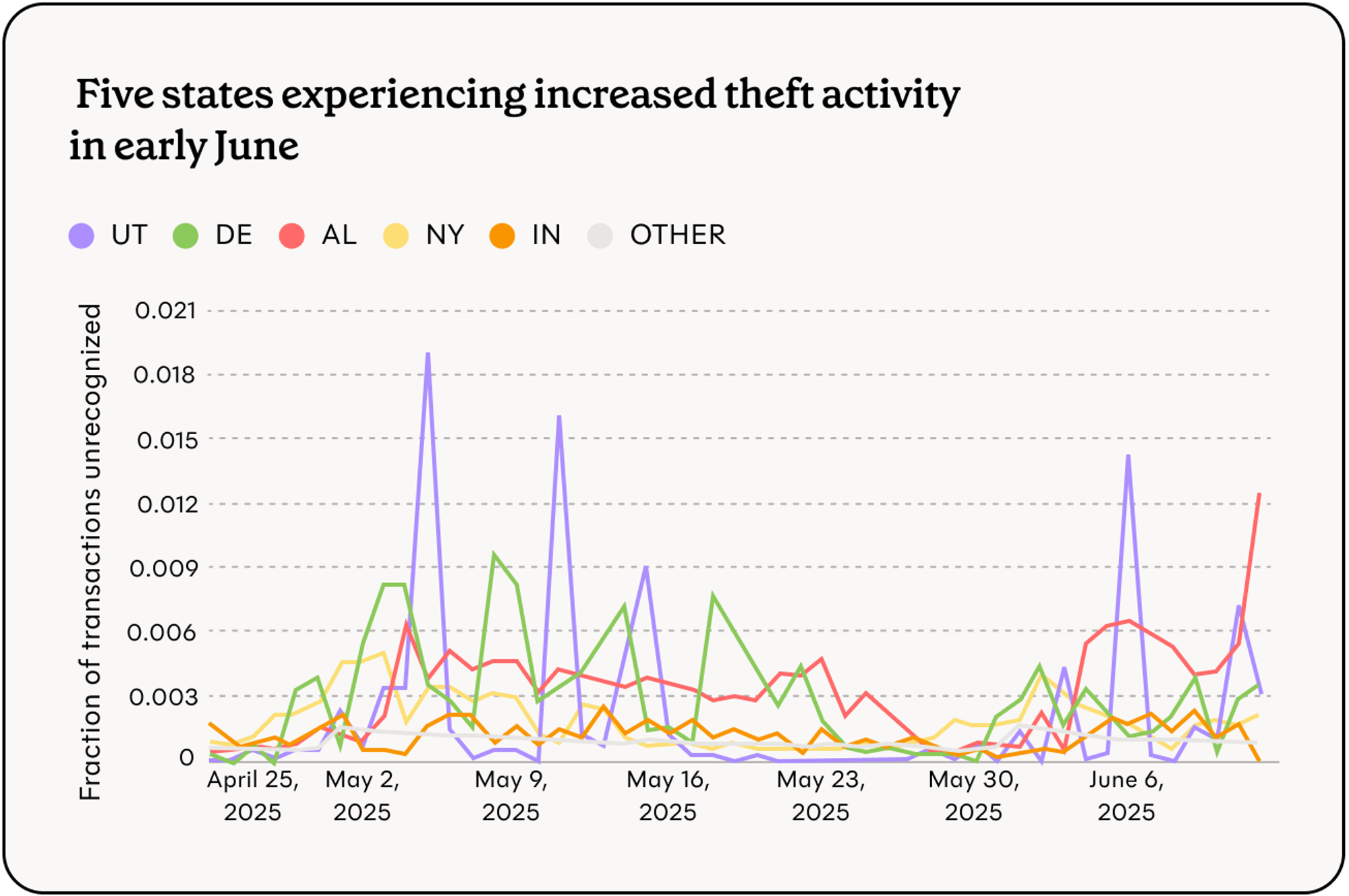

Propel identified increased rates of fraudulent activity in New York in early June.

Key findings#key-findings

- Over the past three months, New York experienced a surge in theft. It now has one of the highest rates of theft nationwide, as well as the highest amount of theft by volume.

- Nationally, skimming patterns are becoming more pronounced as statewide compromise becomes less common.

Propel’s fraud detection capabilities#propels-fraud-detection-capabilities

Propel serves over 5 million EBT cardholders nationwide who use our app to manage their benefits every month. We analyze transaction and customer-reported data to identify emerging theft patterns through a two-step detection process.

First, we identify retailers with unusually high rates of transactions flagged as "unrecognized" by Propel users. These are retailers where stolen benefits appear to be drained or liquidated. Second, we identify skimmer locations by analyzing victims’ shopping patterns in the 12 weeks prior to their card being liquidated.

Our insights are intended to provide a snapshot of emerging trends in EBT theft. We generate these analyses early in the month, when theft activity typically peaks following SNAP benefit deposits. Our data reflects real theft activity, but may show a slight upward bias since cardholders are more likely to check the app after experiencing theft. Given the rapidly evolving nature of EBT theft, our insights represent a current snapshot rather than a comprehensive assessment.

Recent theft patterns and spikes#recent-theft-patterns-and-spikes

Increased rates of theft & continued geographic shifts#increased-rates-of-theft-and-continued-geographic-shifts

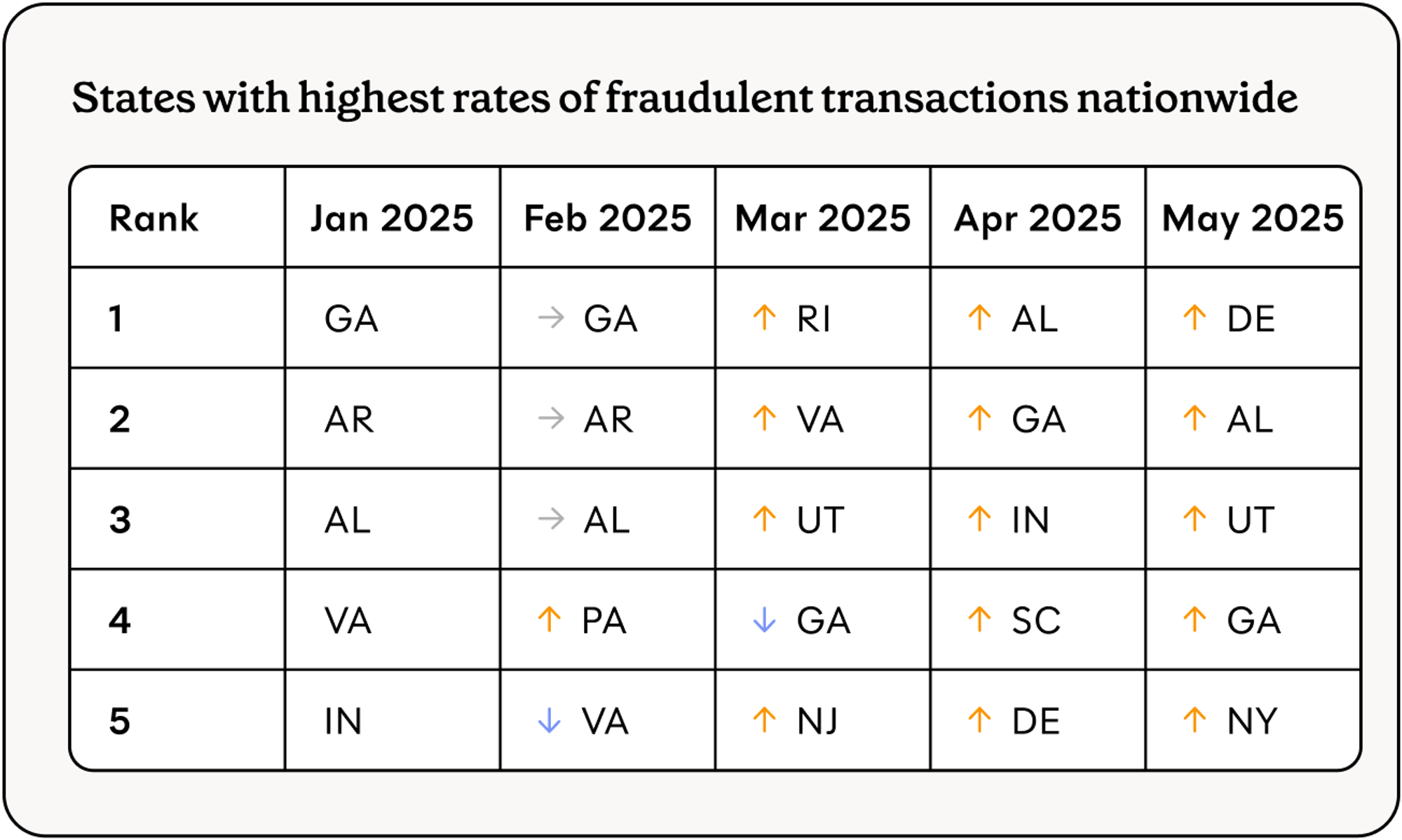

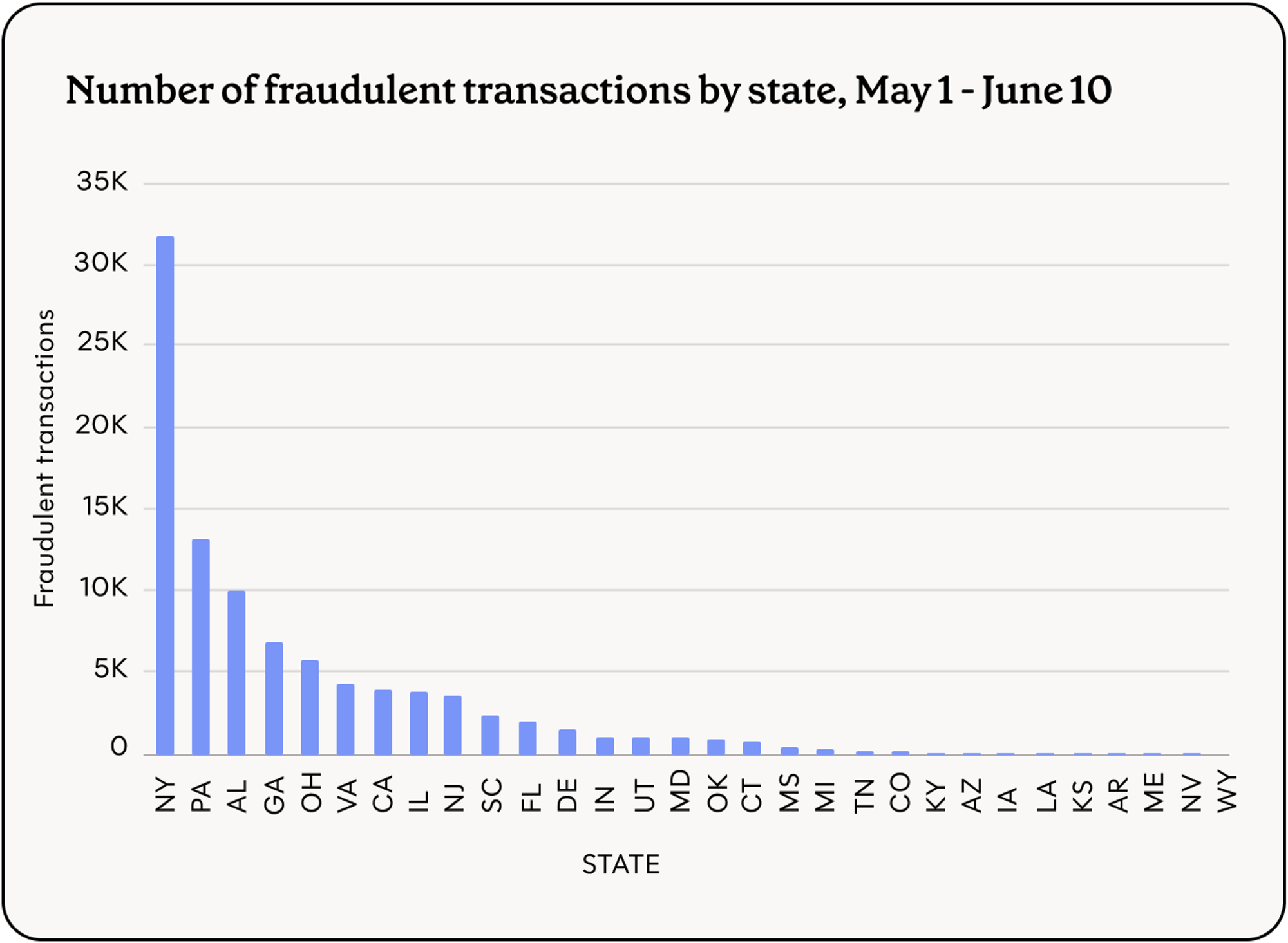

Delaware, Alabama, Utah, Georgia, and New York show some of the highest rates of unrecognized transactions reported by Propel users in May 2025. Due to its large population, New York leads in absolute volume of unrecognized transactions, with nearly three times more than any other state.

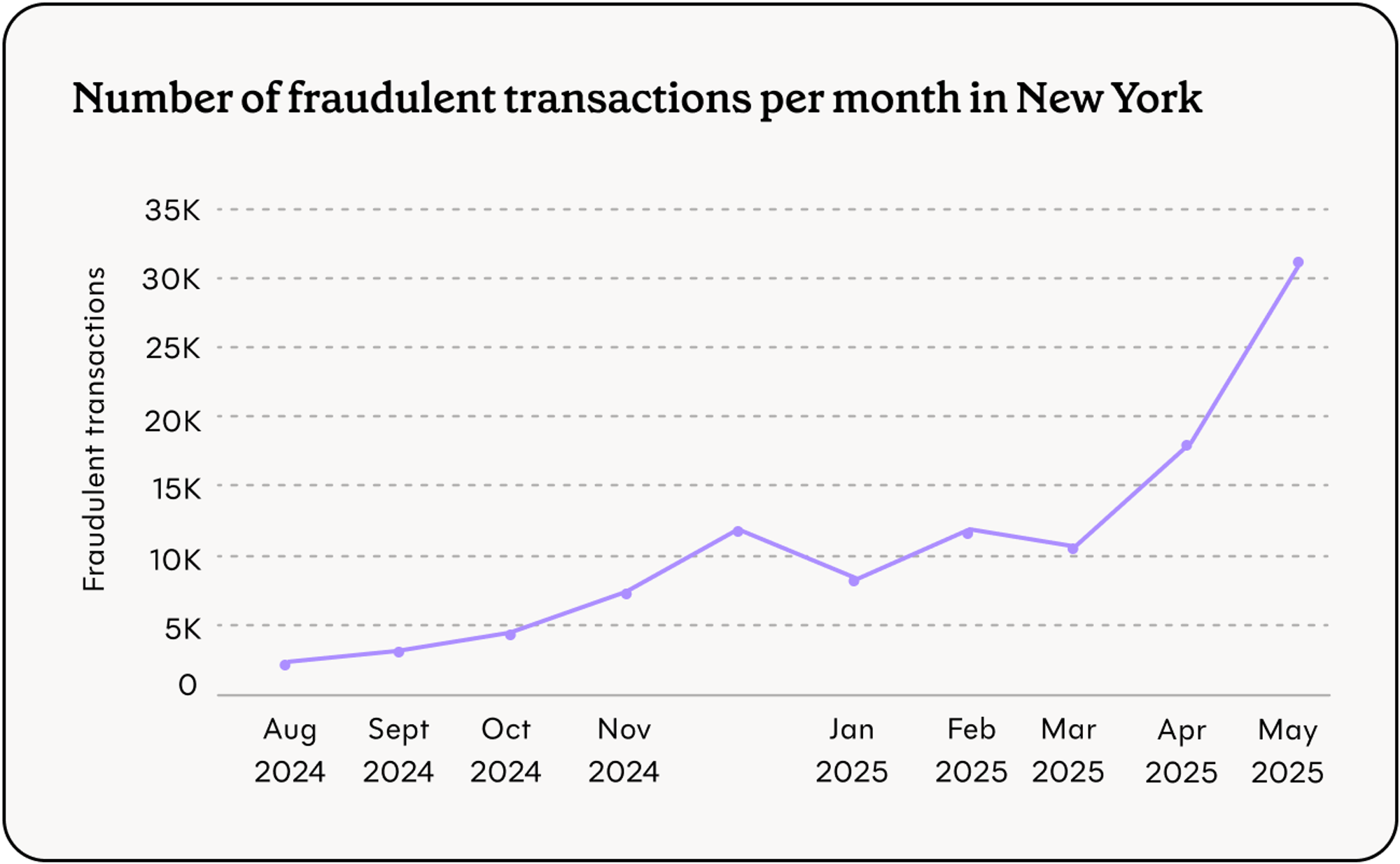

Recent surge in New York#recent-surge-in-new-york

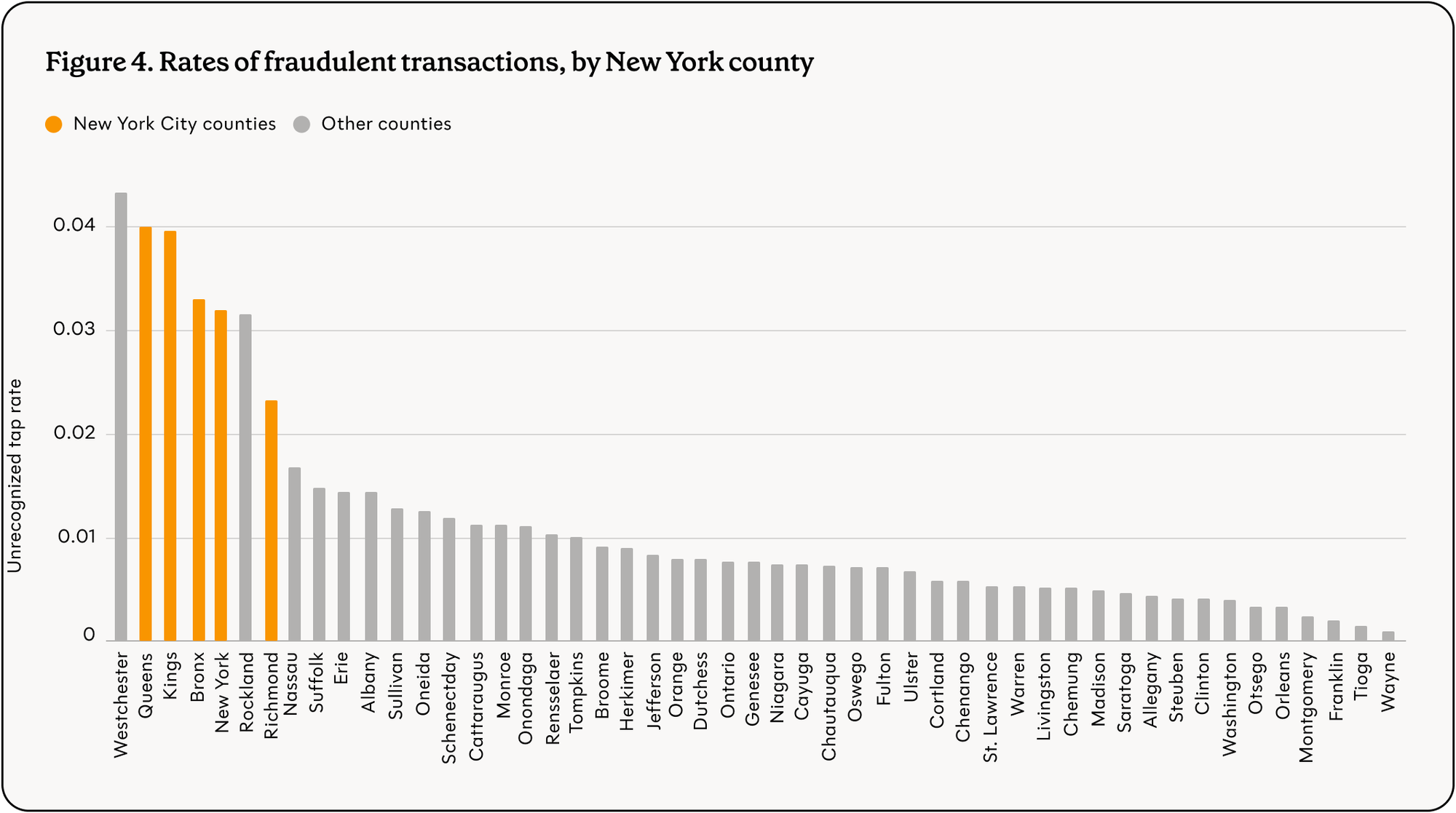

The number of fraudulent transactions across New York State has grown dramatically in recent months. Our analysis suggests that card information is being stolen via skimming operations. Propel users in New York City and neighboring counties are far more likely to experience theft than those in other parts of the state. We have identified hundreds of small corner stores in The Bronx, Brooklyn, and Queens where a high percentage of shoppers subsequently have their funds drained at a known liquidator.

Interestingly, the 10% victim rates are much lower than the 20-40% rates observed in other states. One possible explanation is that criminals do not keep the skimmers at a single location for very long, though this is difficult to confirm. Additionally, neighboring counties of Westchester and Rockland are experiencing levels of theft similar to New York City, indicating the regional scope of the criminal skimming operation (as opposed to systemic vulnerabilities at the municipal level).

Other states#other-states

States experiencing spikes in early June are the same as those reported in early May: Delaware, Utah, Indiana, Alabama, Georgia, and New York. Patterns of theft across all months in 2025 more consistently reflect skimming operations, in contrast to late 2024, when patterns reflecting statewide compromise were dominant. While we continue to see some instances of statewide compromise, they are less common now.

Implications & recommended actions#implications-and-recommended-actions

This data reveals coordinated fraudulent operations targeting SNAP recipients through different mechanisms. In the near term, it may warrant alerts to affected areas, law enforcement coordination, and ongoing monitoring. It may also warrant implementation of established solutions from the financial services industry, like chip cards and real-time transaction blocking, for EBT.

Propel is committed to supporting state and federal agencies in protecting SNAP recipients from EBT theft. For questions about our methodology or further analysis, please reach out.