Can you go to jail for food stamp overpayment?

At a glance

- Criminal charges for overpayment are rare and usually only happen if someone knowingly commits fraud.

- Most overpayments must be repaid, but you have options to appeal or request hardship relief.

- Unpaid overpayments can be collected from future benefits, tax refunds, or wages.

Typically, no. If you have received more SNAP benefits (also called food stamps) than you are eligible for, you have to pay back the funds through repayment. Usually, no criminal charges are involved. Jail becomes a risk only if there's evidence of intentional food stamp fraud, like lying about your income or submitting false documents.

SNAP overpayments can happen for many reasons. If the overpayment was an honest mistake, like forgetting to report a small change in your income or household, then it’s not considered fraud and won’t involve jail time or any other criminal charges.

Learn how to handle a SNAP overpayment notice and what your options are.

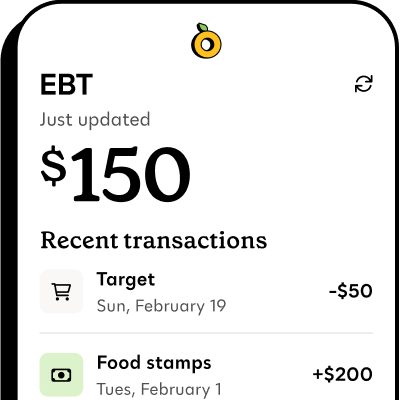

Propel is the #1-rated EBT balance checking app

What is a SNAP overpayment (and how does it happen)?#what-is-a-snap-overpayment-and-how-does-it-happen

A SNAP overpayment is when you get more benefits than you are actually eligible for. Overpayments can result from changes in income or household, or even from administrative errors.

Knowing why an overpayment occurred can help you address the issue quickly and avoid additional penalties.

Common reasons for SNAP overpayment include:

- Household changes: If someone moves in or out of your home, it can change the amount of SNAP benefits you're eligible to receive. Forgetting to immediately report these changes or during your recertification can lead to an overpayment.

- Income changes: Your SNAP benefits are based on your household income. If your earnings go up and you don't let your local SNAP office know, you might end up with more benefits than you qualify for.

- Agency errors: Sometimes the mistake isn't yours at all. State or local agencies can miscalculate benefits, process applications incorrectly, or have delays that accidentally cause an overpayment.

- Intentional fraud: In some cases, overpayments happen because someone deliberately provides false information on their SNAP application, like not reporting all their income or giving inaccurate household information. This can lead to an overpayment because the household receives more benefits than they should.

Do you have to pay back food stamps?#do-you-have-to-pay-back-food-stamps

Yes, most overpaid food stamps must be repaid, even if the mistake wasn’t your fault. The government typically expects households to return benefits that were issued, even in error.

Usually, any adult in the household at the time the overpayment happened is responsible for paying it back. Anyone who caused the overpayment or misused the benefits—like an authorized representative—can also be responsible.

What happens if you have to pay back SNAP?#what-happens-if-you-have-to-pay-back-snap

If the state determines you owe money, you will usually receive a notice of overpayment in the mail. It’s important that you read the notice carefully and respond quickly, as ignoring the notice can potentially worsen penalties.

After receiving a notice, you typically have a few options:

- Pay back the overpayment in installments over time or, if possible, all at once. Instructions on how to do this will be included in the notice letter.

- Appeal the overpayment if you believe it’s incorrect. You can request a hearing, usually within 30 or 90 days of the date on the notice, and provide documents to support your case.

- Request hardship relief. If you weren’t at fault and paying the full amount would prevent you from covering basic living expenses like food, housing, or medical care, this may reduce or even waive the overpayment.

If you don’t take any of these steps, SNAP may automatically reduce your future benefits until the overpayment is repaid.

What are the penalties for not reporting accurate income to SNAP?#what-are-the-penalties-for-not-reporting-accurate-income-to-snap

In most cases, not reporting accurate income or household changes just means you'll need to pay back any benefits you weren't eligible for.

Serious penalties only happen in cases where the SNAP agency thinks you intentionally lied or hid information. Penalties could include:

- Temporary disqualification from SNAP

- Fines

- Criminal charges (rare, but possible)

It’s a good idea to talk to an attorney or your local legal aid program when you are facing SNAP penalties. They can guide you on your options and next steps.

Can SNAP overpayments affect my tax refund?#can-snap-overpayments-affect-my-tax-refund

Yes, if you don’t pay back a SNAP overpayment, your state can take part of your tax refund to cover the debt. They can only do this if they've “legally established” the overpayment, usually by sending notice to your last known address.

You have rights if this happens. You can request a hearing within 30 days after you learn of the collection action, if you never received the notice or you think the notice is incorrect. You’ll need to provide proof, like records of any payments you've already made.

If the issue isn’t resolved, the state can also garnish your wages—meaning they can take a portion of your paycheck—or use other methods to collect the overpayment.