How much can a disabled person get in food stamps?

In 2020, the average SNAP benefit for one person under age 60 with a disability was $110 per month.

When you apply for SNAP ( also called food stamps) your eligibility and benefit amount are mainly determined by your household size and income. Having a disability changes how your income is calculated, and can make it easier to qualify for SNAP.

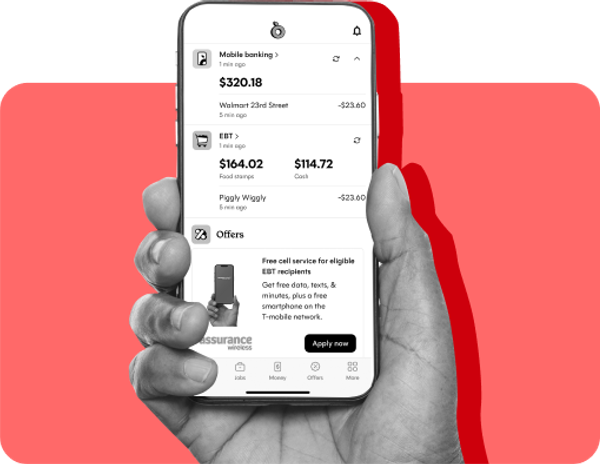

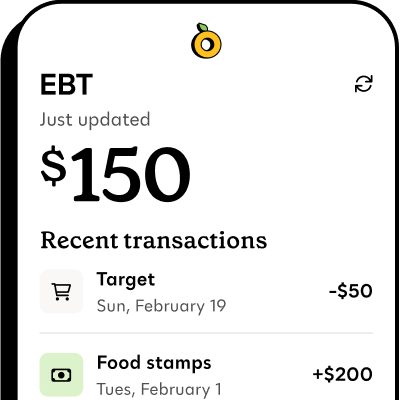

Propel is the #1-rated EBT balance checking app

What counts as a disability for SNAP?#what-counts-as-a-disability-for-snap

You’re considered disabled for SNAP purposes if any of the following applies to you:

- You get federal Social Security disability or blindness payments, including SSI

- You get state disability or blindness payments that follow SSI rules

- You get disability retirement payments from a government agency for a permanent disability

- You get Railroad Retirement payments with Medicare eligibility or SSI disability status

- You’re a veteran who is completely handicapped, permanently homebound, or needs full-time care

- You’re a surviving spouse or child of a veteran who gets VA benefits for a permanent disability

How SNAP calculates your benefits if you have a disability#how-snap-calculates-your-benefits-if-you-have-a-disability

The SNAP program expects households to spend about 30 percent of their money on food. To estimate your SNAP benefit amount:

- Calculate your household’s monthly net income (keep reading to find out how)

- Multiple by 0.3 and round up

- Subtract that number from the maximum benefit for your household size

Maximum monthly SNAP benefit based on household size (October 1, 2024 to September 30, 2025)

| Household size | Maximum monthly SNAP benefit |

|---|---|

| 1 | $292 |

| 2 | $536 |

| 3 | $768 |

| 4 | $975 |

| 5 | $1,158 |

| 6 | $1,390 |

| 7 | $1,536 |

| 8 | $1,756 |

| Each additional person | +$220 |

*There are different SNAP maximums in Alaska, Hawaii, Guam, and the U.S. Virgin Islands

SNAP income rules for people with disabilities#snap-income-rules-for-people-with-disabilities

If you get Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI), these count as income for SNAP, but you’ll also get special deductions on your food stamp application for expenses like rent and medical bills that lower your counted income. The lower your counted income, the more SNAP benefits you can receive.

Your income must be below a certain amount to qualify for SNAP. The limit varies by state and household size—but it’s typically $2,510 or less monthly for one person. SNAP household income limits are set every year in October.

Your household includes:

- Anyone who lives with you and also buys and prepares food with you

- Spouses and children under 22, even if they prepare meals separately

If you're over age 60 and have a permanent disability that prevents you from preparing your own meals, you and other people you live with could be considered a separate household if other household members earn less than 165 percent of the federal poverty level.

Federal poverty guidelines for 2025

| Household size | Annual income at 165% of the poverty level |

|---|---|

| 1 | $25,823 |

| 2 | $34,898 |

| 3 | $43,973 |

| 4 | $53,048 |

| 5 | $62,123 |

| 6 | $71,198 |

| 7 | $80,273 |

| 8 | $89,348 |

| Each additional person | + $9,075 |

Households with elderly or disabled members can still qualify even if you live in subsidized housing or nonprofit group housing that provides meals.

Additionally, households with only seniors or people with disabilities don’t have to meet work requirements for SNAP.

How to calculate net income for households with disabilities#how-to-calculate-net-income-for-households-with-disabilities

Most households must meet both gross and net income limits to qualify for SNAP. But if someone in your household is elderly or disabled, you only need to meet the net income test.

Your net income = Gross income - deductions#your-net-income-gross-income-deductions

Both earned income (what you make from working) and unearned income (like SSI, veterans, disability, and other benefits) count when calculating your income for SNAP.

“Deductions” are everyday and recurring expenses that the SNAP office will subtract from your income.

They work like discounts that lower your counted income, which can help you qualify for SNAP or get more benefits. Remember to claim as many deductions as possible to maximize your food stamps amount.

Here are important deductions for people with disabilities:

- Medical expenses: Medical costs over $35 a month may be deducted from your net income calculation if they’re not paid by insurance or someone outside of your household. This includes:

- Cost of doctor visits and prescriptions

- Over-the-counter medication

- Dentures and dental care

- Hospital costs

- Nursing and attendant care

- Transportation for medical care

- Health insurance premiums

Only the amount above $35 can be subtracted from your income, and you’ll need to show proof of these out-of-pocket expenses.

- Shelter costs: If someone in your household is disabled, you can subtract all housing costs that are half of your household income.

- Earnings deduction: If you have earned income, subtract 20 percent of your earned income

Other common deductions you can claim on your SNAP application include:

- Dependent care deduction: Money you spend on childcare or caring for other dependents so you can work, go to school, or get training

- Child support deduction: Money you legally must pay for child support

Example net income calculation for a two-person household with disabilities and no earned income:

- Gross income: $1,500 Social Security + $300 pension = $1,800 gross income

- Standard deduction for a 2-person household (all SNAP households receive this to account for basic living costs): $1,800 - $204 = $1,596

- Medical expenses over $35: $1,596 - $200 = $1,396

- Half of adjusted income: $1,396 ÷ 2 = $698

- Excess housing costs: $1,000 total housing costs - $698 = $302

- Net monthly income: $1,396 - $302 = $1,094

This household passes the net income test since $1,094 is below the $1,704 monthly limit for a two-person household in the 48 contiguous states and Washington, D.C.

Does SSI automatically qualify you for SNAP?#does-ssi-automatically-qualify-you-for-snap

If everyone in your household gets SSI, you may automatically qualify for SNAP benefits without meeting the net income test.

Does disability count as income?#does-disability-count-as-income

Yes. Both earned income (like wages) and unearned income (like SSDI payments) count as income when you apply for SNAP.

Don’t forget to claim medical, shelter, and other deductions to lower your countable income and help you qualify for SNAP.

Balance your grocery budget and get access to deals with Propel

How to apply for SNAP if you have a disability#how-to-apply-for-snap-if-you-have-a-disability

People with disabilities may request special accommodations when applying for SNAP:

- If you can't visit the SNAP office or use the internet, another person can apply for you as your representative. You'll need to put this in writing.

- If your household has only seniors or people with disabilities and no earned income, you'll automatically get a phone interview instead of having to visit in person.

- You always have the right to free application assistance from family or friends, community organizations or advocacy groups, legal aid groups, or SNAP office employees.